Market Changes Affect Risk Tolerance, MU Study Finds

As the U.S. economy continues to lag, many investors remain wary about taking risks with the stock market. Now, researchers at MU have concluded that this attitude toward investment risk-taking is more than just a recent trend.

Rui Yao, a University of Missouri assistant professor in the Personal Financial Planning department in the College of Human Environmental Sciences, has found that during the past two decades, the risk tolerance of investors is positively correlated to the movements of the stock market, meaning that investors are likely to invest more when market returns are high, and withdraw partially or even completely from the market when returns are negative.

Rui Yao, a University of Missouri assistant professor in the Personal Financial Planning department in the College of Human Environmental Sciences.

Yao warns that this tendency will ultimately lead to ineffective investment tactics and unnecessary financial losses. She says that a positive correlation between risk tolerance and stock market returns shows that investors are buying stocks at a high price and selling them at a low price, which is not sound investment strategy.

“To maximize returns, the ideal strategy is to buy stocks at a low price, with the hope of selling them at a higher price,” Yao said. “However, many investors seem to be unwilling to take risks when the market is at a low point and seem content to only invest when the market is at a high point.”

In her study, Yao examined the Health and Retirement Study (HRS) to investigate changes of risk tolerance levels over time in response to stock market returns. The HRS is a longitudinal study conducted by the University of Michigan since 1992. During the course of the study, participants were given hypothetical scenarios about income gambles and were assigned to a level of risk tolerance based on their answers. The study tracked the responses of each participant between 1992 and 2006 and compared it to the state of the stock market at the time of each response.

Yao found that many Americans are not behaving according to rational economic model assumptions. She says that such changes in risk tolerance in response to market returns may be an indication that investors, and possibly their financial advisors, overestimate their ability to understand risk and assess individual risk tolerance.

“Having the ability to understand risks and assess risk tolerance has a direct impact on individual well-being,” Yao said. “Ultimately, improved financial education is the best way to help Americans overcome the bias of over-weighting recent market performance when making investment decisions.”

This study was published in the Journal of Economic Issues.

Media Contact

More Information:

http://www.missouri.eduAll latest news from the category: Business and Finance

This area provides up-to-date and interesting developments from the world of business, economics and finance.

A wealth of information is available on topics ranging from stock markets, consumer climate, labor market policies, bond markets, foreign trade and interest rate trends to stock exchange news and economic forecasts.

Newest articles

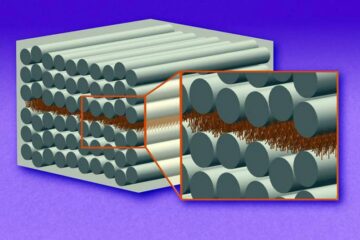

“Nanostitches” enable lighter and tougher composite materials

In research that may lead to next-generation airplanes and spacecraft, MIT engineers used carbon nanotubes to prevent cracking in multilayered composites. To save on fuel and reduce aircraft emissions, engineers…

Trash to treasure

Researchers turn metal waste into catalyst for hydrogen. Scientists have found a way to transform metal waste into a highly efficient catalyst to make hydrogen from water, a discovery that…

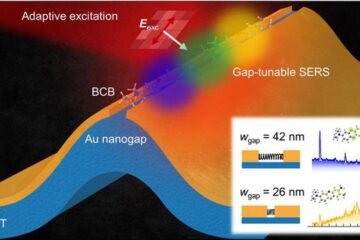

Real-time detection of infectious disease viruses

… by searching for molecular fingerprinting. A research team consisting of Professor Kyoung-Duck Park and Taeyoung Moon and Huitae Joo, PhD candidates, from the Department of Physics at Pohang University…