Making a Case for Transparent Corporate Accounting Information

“Cost of Capital and Earnings Transparency,” (published in the Journal of Accounting and Economics, April-May 2013) establishes that the transparency of a firm’s accounting earnings is a telling indicator of the company’s cost of capital and thus its valuation, according to Konchitchki. The paper is co-authored with Mary E. Barth, Stanford Graduate School of Business, and Wayne R. Landsman, University of North Carolina at Chapel Hill’s Kenan-Flagler Business School.

Cost of capital is defined as the rate of return that capital could be expected to earn in an alternative investment of equivalent risk. It is used to evaluate new projects within a company to give investors information and assurance of a minimum return for providing capital.

The paper, says Konchitchki, has the potential to change how capital market participants consider the quality of accounting data from corporate financial statements because the findings illuminate the importance of transparency for stock valuation. “Our findings are especially notable today, when these market participants are concerned with accounting financial statements becoming less transparent and thus less useful,” says Konchitchki. “In fact, many blame corporations’ lack of accounting transparency for the recent financial crisis in the U.S. and the recession that followed.”

A firm’s valuation is often determined by discounting future cash flows by the firm’s cost of capital, Konchitchki explains. The study finds that the cost of capital is negatively related to transparency. Intuitively, when there is less earnings transparency, the risk to investors is higher, resulting in higher cost of capital. Likewise, if there is more earnings transparency, one has access to more information about a company’s value by observing its earnings, resulting in lower risk and, in turn, lower cost of capital. Ultimately, lower cost of capital equates to higher firm value.

Konchitchki says the study’s conclusion becomes clearer by observing the calculations: the cost of capital is the important denominator when calculating a company’s value. If future cash flows provided by the investment are divided by the cost of capital, the result equals the value of the investment, i.e., the firm value.

Konchitchki, assistant professor, Haas Accounting Group, specializes in capital markets research and financial statements analysis. He particularly examines the usefulness of accounting information through its links to macroeconomics (e.g., inflation; GDP) and valuation (e.g., cost of capital; asset pricing).

The researchers studied a sample of publicly traded U.S. companies over a 27-year period. They tested their hypothesis that transparency affects a firm’s value by modeling how the cost of capital changes dependent on the lack or abundance of information. They considered “transparency” on a range from zero percent to 100 percent whereas categories of information may include sales, growth, management quality, global offices, cost of goods sold, etc. For example, 100 percent earnings transparency means that accounting earnings offer the ability to fully explain changes in a firm’s value. Lower percentages of transparency means more information than earnings is needed to explain changes in a firm’s value.

Konchitchki refers to the economic mechanism that drives the link between transparency and cost of capital as the “information asymmetry” effect.

“When the amount of available information is not symmetrical, some investors will have more information, others will have less. This drives the significant negative relation between earnings transparency and the cost of capital, and thus our paper also provides the economic intuition that links between transparency and valuation,” says Konchitchki.

Media Contact

More Information:

http://haas.berkeley.edu/faculty/papers/konchitchki_transparency.pdfAll latest news from the category: Business and Finance

This area provides up-to-date and interesting developments from the world of business, economics and finance.

A wealth of information is available on topics ranging from stock markets, consumer climate, labor market policies, bond markets, foreign trade and interest rate trends to stock exchange news and economic forecasts.

Newest articles

Bringing bio-inspired robots to life

Nebraska researcher Eric Markvicka gets NSF CAREER Award to pursue manufacture of novel materials for soft robotics and stretchable electronics. Engineers are increasingly eager to develop robots that mimic the…

Bella moths use poison to attract mates

Scientists are closer to finding out how. Pyrrolizidine alkaloids are as bitter and toxic as they are hard to pronounce. They’re produced by several different types of plants and are…

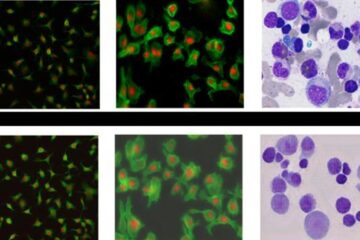

AI tool creates ‘synthetic’ images of cells

…for enhanced microscopy analysis. Observing individual cells through microscopes can reveal a range of important cell biological phenomena that frequently play a role in human diseases, but the process of…