Lack of Credit Forces Many Small Business Owners to Finance with Personal Assets

Small businesses are seen as an important part of the American economy. These businesses often rely heavily on loans to stay afloat.

The recent economic recession has created a reduction in available credit for many small businesses, making it difficult for many businesses to operate.

Tansel Yilmazer, assistant professor in the personal financial planning department in the College of Human Environmental Sciences at the University of Missouri, says that lack of available credit has forced many small business owners to use their household savings or other personal assets to support their businesses, putting their personal assets at risk.

Tansel Yilmazer is an assistant professor in the personal financial planning department in the College of Human Environmental Sciences at the University of Missouri.

Yilmazer says that due to the present reduction in credit availability, small and family-owned businesses look to reduce their dependence on outside financing by utilizing two general strategies. The first strategy involves diminishing or eliminating the need for financing by reducing the cost of operations and carefully managing the cash flow of the business. The second type is to acquire finances by raising money from personal and other sources external to the business without resorting to bank loans.

Yilmazer says that businesses that use owner resources and delay payments for household expenses are the ones that typically report a need for further financing for their businesses. Because these business owners have not established relationships with banks, they may face problems obtaining future bank loans. Yilmazer says the recent recession has affected the direction of the resource flow from household to business and the owners might be putting their own assets at risk for the business.

“Recession has increased the risk of business failure,” Yilmazer said. “Since business is inherently risky, financing with owner resources would seem to extend that risk to the household in ways that owners may not be adequately considering.”

Yilmazer found that the use of financial resources is a two-way street in small and family-owned businesses, confirming that the family and business interact and resource exchanges occur in both directions. She says that while small businesses can provide income for households, owners need to be aware that financing a business from household funds opens the door for household assets to become susceptible to loss.

“Business ownership is an important household investment,” Yilmazer said. “Ownership may serve as a source of income and expenses as well as an investment vehicle, but it is not generally understood or considered as a household portfolio risk. Small and family businesses may be riskier than other investments because they are more susceptible to attrition.”

Yilmazer’s study was published in the Journal of Family and Economic Issues and was co-authored with Holly Schrank from Purdue University.

Media Contact

More Information:

http://www.missouri.eduAll latest news from the category: Business and Finance

This area provides up-to-date and interesting developments from the world of business, economics and finance.

A wealth of information is available on topics ranging from stock markets, consumer climate, labor market policies, bond markets, foreign trade and interest rate trends to stock exchange news and economic forecasts.

Newest articles

Silicon Carbide Innovation Alliance to drive industrial-scale semiconductor work

Known for its ability to withstand extreme environments and high voltages, silicon carbide (SiC) is a semiconducting material made up of silicon and carbon atoms arranged into crystals that is…

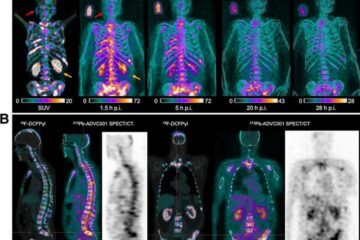

New SPECT/CT technique shows impressive biomarker identification

…offers increased access for prostate cancer patients. A novel SPECT/CT acquisition method can accurately detect radiopharmaceutical biodistribution in a convenient manner for prostate cancer patients, opening the door for more…

How 3D printers can give robots a soft touch

Soft skin coverings and touch sensors have emerged as a promising feature for robots that are both safer and more intuitive for human interaction, but they are expensive and difficult…