KfW upbeat as second half kicks off / Funding volume of 75 bn EUR confirmed

Promotional bank committed to securitisations “Made in Germany”

At its semi-annual Capital Markets Press Briefing in London, KfW today confirmed its anticipated funding volume of 75 bn EUR for 2010. Germany's largest promotional bank is brimming with confidence concerning the funding of its promotional lending business. 'We have a globally oriented and acknowledged funding strategy, and are extremely well positioned in the international capital markets; the first six months, which were highly volatile, once again provided an impressive demonstration of this', said Dr. Günther Bräunig, Member of the Managing Board of KfW Bankengruppe.

KfW, one of Europe's largest issuers, believes that market conditions will remain volatile over the next six months, and that the public finance situation in the eurozone will continue to unsettle many market participants. Firm austerity measures designed to achieve financial stability are needed. In Europe there is a strong political will to achieve this. KfW also believes that the emerging European Financial Stability Facility (EFSF) has the potential to gradually ease existing tensions on the international capital markets, and thus restore confidence.

Bräunig expressed his conviction that KfW's prime German credit quality will appeal to international investors. As in the first six months, KfW will continue to offer its investors a broad array: high-liquidity and high-volume global bonds in EUR and USD, and bonds whose maturity, denomination and structure can be flexibly adapted to meet investor requirements.

During the first six months KfW raised some 45.8 bn EUR on the international capital markets. 221 bonds were issued in 17 different currencies. Bonds denominated in EUR and USD made up the lion's share of these issues (44% and 34% respectively), followed by the AUD, the GBP and the JPY. Demand for bonds in NOK was also strong.

Worldwide, KfW is the only non-governmental issuer that has issued large bonds in all benchmark maturities in both EUR and USD, and thus offers a liquid reference curve. 'The fact that we were so successful in placing our 5 bn EUR / 4 bn USD 10-year benchmarks underlines our permanent access to the markets, and especially to long-term funds.

This is very important also for the future stability of our funding', emphasised Bräunig.

It has clearly emerged that investors are now drawing a sharper distinction between issuers from euro and non-euro countries, as well as between issuers from core and peripheral euro countries. Investors examine very closely, and evaluate very precisely, the guarantee, the clout of the guarantor and the shareholder structure of an issuer.

Thanks to its explicit, direct guarantee provided by the Federal Republic of Germany as the safest and financially strongest state in the eurozone, and its clear and simple shareholder structure, KfW is extremely well placed.

As to the development of the securitisation markets, where KfW has been active since 10 years as well, the first pleasing chinks of light can now be seen in Europe. During the first half of 2010 a volume of around 28 bn EUR was placed publicly – three times the amount placed in the whole of 2009.

Nonetheless, there is still a long way to go before one can speak of a normalisation of the securitisation market. Uncertainty concerning the plans for regulation is partially responsible for the high volatility in this market segment. 'At the same time, though, we observe how the planned regulatory requirements, and the more restrictive monetary policy of the ECB anticipated in the medium term, are making securitisation more attractive. Banks are once again showing a strong interest in securitisation as a means of easing the burden on their equity capital and of making their refinancing less dependent on the ECB', explained Bräunig. In line with these developments, a deal pipeline has begun to build up on KfW's securitisation platforms.

The securitisation industry needs to keep up its efforts in restoring investor confidence. A key step in this direction is the 'German Securitisation Standard' developed by TSI and the Association of German Banks, a process in which KfW was actively involved.

For high-quality securitisations “Made in Germany”, banks undertake to comply with key quality standards such as securitisation from existing loan portfolios only, an appropriate retention (at least 5%) and no re-securitisations. This response to the key lessons learned from the crisis places securitisation on a sound basis. First transactions using this new standard may be completed this year.

'KfW is ready to make its contribution towards financing the economic recovery. We are optimally placed for the funding required in this connection. We also intend to support selected securitisation transactions as an anchor investor, in order to help revitalise the securitisation market and ultimately also help secure the supply of credit to SMEs and the housing construction sector', said Bräunig.

For more detailed information, please refer to your press kit at:

www.kfw.de/press .

Media Contact

More Information:

http://www.kfw.deAll latest news from the category: Business and Finance

This area provides up-to-date and interesting developments from the world of business, economics and finance.

A wealth of information is available on topics ranging from stock markets, consumer climate, labor market policies, bond markets, foreign trade and interest rate trends to stock exchange news and economic forecasts.

Newest articles

Superradiant atoms could push the boundaries of how precisely time can be measured

Superradiant atoms can help us measure time more precisely than ever. In a new study, researchers from the University of Copenhagen present a new method for measuring the time interval,…

Ion thermoelectric conversion devices for near room temperature

The electrode sheet of the thermoelectric device consists of ionic hydrogel, which is sandwiched between the electrodes to form, and the Prussian blue on the electrode undergoes a redox reaction…

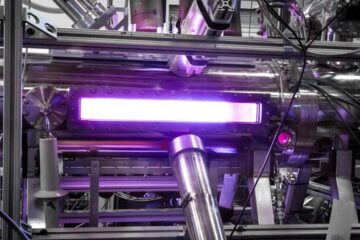

Zap Energy achieves 37-million-degree temperatures in a compact device

New publication reports record electron temperatures for a small-scale, sheared-flow-stabilized Z-pinch fusion device. In the nine decades since humans first produced fusion reactions, only a few fusion technologies have demonstrated…