KfW successfully opens its 2009 Euro Benchmark Programme with a 10-year Global

The benchmark bond I/2009 matures on 21 January 2019, pays a coupon of 3.875% p.a. and carries a re-offer price of 99.471 (with a 3.94% yield). This corresponds to a yield pick-up of 95.7 basis points over the Bund maturing in January 2019. Lead managers of the transaction are Deutsche Bank, Credit Suisse and BNP Paribas. The Global has received the same AAA/Aaa/AAA ratings from Fitch Ratings, Moody's and Standard & Poor's as all KfW bonds.

“We knew that the situation in the market would be challenging. So we are highly pleased that we were able to start our 2009 Euro Benchmark Programme with a 10-year global bond”, said Frank Czichowski, KfW Treasurer. “We succeeded in placing a volume of EUR 3 bn mainly with European investors – a good result in these times and in this maturity segment”.

Given the very high number of comparable bonds expected to be placed in the European capital market, KfW got a head start by announcing its issuing plans and commissioning the lead managers for this transaction already at the end of 2008.

A steep yield curve and a lack of issues in the long-term maturity segment were the key factors that prompted KfW to offer a 10-year bond in the market. The last 10-year bond issued in the market segment “Supras, Sovereigns and Agencies” was also issued by KfW, one year ago in January.

The order book for the Euro Benchmark I/2009 was opened on Monday morning and filled steadily, which is typical for issues in the long-term segment. The book was closed on Tuesday around noontime with more than 180 individual orders adding up to over EUR 5.4 bn. KfW was thus able to place a well-diversified EUR 3 bn transaction.

The breakdown of the order book by sector is as follows:

Breakdown by investor type:

Banks: 52%

Funds: 25%

Central banks: 14%

Insurance companies: 9%

Geographical breakdown:

Europe: 82%

Germany: 32 %

France: 25 %

Switzerland:10 %

Great Britain: 5 %

Others: 10 %

Asia: 12 %

Americas: 6 %

This press release is not an offer of securities for sale in the United States. Securities may not be offered or sold in the United States absent registration or an exemption from registration. KfW has registered the securities that are the subject of this press release for sale in the United States. The offering of the securities in the United States will be made by means of a prospectus that may be obtained from KfW and will contain detailed information about KfW and its management, financial statements and information about the Federal Republic of Germany.

Term Sheet KfW EUR Benchmark I/2009

EUR 3 bn -3.875% – 2009/2019

ISIN: DE000A0L1CY5

Issuer: KfW

Guarantor: Federal Republic of Germany

Rating: AAA (Fitch Ratings) / Aaa (Moody's) / AAA (Standard &

Poor's)

Size: 3,000,000,000 EUR

Maturity Date: 20. January 2009 – 21. January 2019

Coupon: 3.875% p.a

Re-offer-Price: 99.471

Yield: 3.94% p.a.

Format: Global

Listing: Frankfurt

Lead Manager (3):

BNP Paribas

Credit Suisse

Deutsche Bank

Co-Lead Manager (12):

Banca Akros Gruppo BPM

Barclays

Calyon

Citigroup

Danske Bank A/S

Dresdner Kleinwort

DZ Bank

Goldman Sachs

Morgan Stanley

Nomura

RBS

UBS

Selling Group (8):

Fortis

ING

Natixis

Nordea Bank Danmark A/S

Santander

SEB

Société Générale Corporate & Investment Banking

Unicredit (HVB)

Media Contact

More Information:

http://www.kfw.deAll latest news from the category: Business and Finance

This area provides up-to-date and interesting developments from the world of business, economics and finance.

A wealth of information is available on topics ranging from stock markets, consumer climate, labor market policies, bond markets, foreign trade and interest rate trends to stock exchange news and economic forecasts.

Newest articles

Silicon Carbide Innovation Alliance to drive industrial-scale semiconductor work

Known for its ability to withstand extreme environments and high voltages, silicon carbide (SiC) is a semiconducting material made up of silicon and carbon atoms arranged into crystals that is…

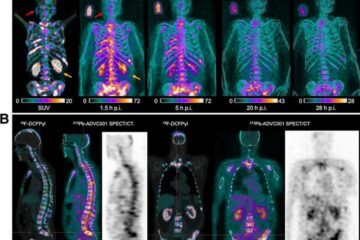

New SPECT/CT technique shows impressive biomarker identification

…offers increased access for prostate cancer patients. A novel SPECT/CT acquisition method can accurately detect radiopharmaceutical biodistribution in a convenient manner for prostate cancer patients, opening the door for more…

How 3D printers can give robots a soft touch

Soft skin coverings and touch sensors have emerged as a promising feature for robots that are both safer and more intuitive for human interaction, but they are expensive and difficult…