KfW IPEX-Bank doing well in its first year of independence

In 2008, its first year of legal independence, KfW IPEX-Bank GmbH achieved strong growth in its volume of new business, which totalled EUR 12.1 billion as at the end of November.

In addition, for the account of KfW it conducted export and project financing transactions in the amount of approx. EUR 4.1 billion (transactions conducted on a trust basis). In this way, KfW IPEX-Bank is making an important contribution to KfW's legal mandate to promote the German and European economy.

Heinrich Heims, Speaker of the Board of Managing Directors, reported on the business development and results of 2008 in Frankfurt on Monday. By the end of November, the bank had exceeded its goal for the year, with new commitments adding up to a good EUR 12 billion. In its business it aims to establish a balanced regional distribution of its portfolio. “To achieve this we seek to divide our portfolio into thirds representing Germany, the rest of Europe and regions outside Europe”, announced Heims. “Outside Europe we focus primarily on markets and customers with which we have mostly had a good business relationship over many years.”

In its domestic business KfW IPEX-Bank has committed over EUR 3.7 billion altogether, with finance for German shipping companies, manufacturing and commerce accounting for the largest share. In Europe the bank has committed new loans totalling EUR 5 billion. Its new commitment volume reached EUR 3.4 billion in the regions outside Europe.

During 2008 KfW IPEX-Bank also broadened its network of representative offices by adding Johannesburg, and an office in Abu Dhabi is currently under foundation. Another major step was the conversion of the London representative office into a branch which will specialise in financing infrastructure projects.

By the end of the third quarter on 30 September, the balance sheet total of KfW IPEX-Bank was EUR 52.8 billion. The earnings from operations – net income and commission income – were well above the level of previous years.

Nevertheless, the financial market crisis has left traces.

Earnings have been reduced by write-downs in the book value of financial assets which always have to be valued currently in strict observance of the lower of cost or market principle. “Since our last quarterly accounts we have had to book considerable valuation losses on our liquidity portfolio”, said Heims. As the financial crisis and, hence, the fluctuations of market value in the financial markets are continuing, a forecast regarding the annual result is not yet given.

Given the cyclical downturn, monitoring the loan portfolio will be especially vital in the new year. This will also necessitate higher risk provisions. “We benefit from the fact that the loan portfolio of KfW IPEX-Bank is well diversified in risk terms thanks to our regional and sectoral market strategy. Besides, we hold valuable collateral as well as state guarantees in our export finance business and for direct investments by German companies abroad”, added Heims.

“But we are also prepared for a rise in the number of critical loans that is sure to occur next year.”

For 2009 Heims expects lower demand for financing as businesses put off or cancel investment projects, but also a reduced supply of credit as a result of the financial market crisis. For KfW IPEX-Bank he anticipates that new loan commitments will decline to around EUR 8-10 billion in 2009. This planning scenario takes account of the fundamentally new situation in the market. Although the business volume will not reach the current year's level, it will still reflect the original envisaged growth path. “First and foremost we want to show that we intend to stay consistently in line with the market”, said Heims.

About KfW IPEX-Bank GmbH

Within KfW Bankengruppe KfW IPEX-Bank GmbH provides project and corporate financing as well as trade and export financing domestically and abroad. Worldwide it conducts all market activities of KfW Bankengruppe that are carried out on commercial terms. KfW IPEX-Bank GmbH has been operating as a legally independent subsidiary since 1 January 2008 and contributes significantly to the promotional mission of KfW Bankengruppe. It has approx. 490 employees (as of October 2008) and is represented in the key economic and financial centres across the globe.

Media Contact

More Information:

http://www.kfw-ipex-bank.deAll latest news from the category: Business and Finance

This area provides up-to-date and interesting developments from the world of business, economics and finance.

A wealth of information is available on topics ranging from stock markets, consumer climate, labor market policies, bond markets, foreign trade and interest rate trends to stock exchange news and economic forecasts.

Newest articles

Bringing bio-inspired robots to life

Nebraska researcher Eric Markvicka gets NSF CAREER Award to pursue manufacture of novel materials for soft robotics and stretchable electronics. Engineers are increasingly eager to develop robots that mimic the…

Bella moths use poison to attract mates

Scientists are closer to finding out how. Pyrrolizidine alkaloids are as bitter and toxic as they are hard to pronounce. They’re produced by several different types of plants and are…

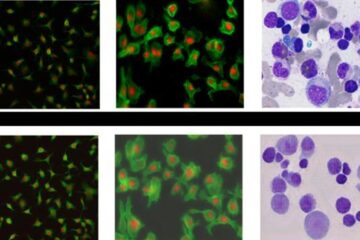

AI tool creates ‘synthetic’ images of cells

…for enhanced microscopy analysis. Observing individual cells through microscopes can reveal a range of important cell biological phenomena that frequently play a role in human diseases, but the process of…