KfW's 4th USD Global Transaction in 2010 illustrates the strength of its USD Programme

The USD 4 billion bond matures on June 15, 2012 and carries a coupon of 1.25 %. The reoffer price was set at 99.86 %, corresponding to a yield-pick up of 29.25 basis points (bp) over the US-Treasury, maturing in March 2012. Lead managers of the transaction were Bank of America/Merrill Lynch, BNP Paribas and HSBC. Co-lead managers were Barclays, Credit Suisse, Deutsche Bank, Mizuho, Mitsubishi UFG, Morgan Stanley, Royal Bank of Canada CM, Royal Bank of Scotland, Toronto Dominion and UBS.

The deal was announced on April 14, 2010, New York morning with an initial price guidance of +5 to+7 bp over the mid swap rate. From the start there was strong and broad based demand from high quality investors out of North America. The book exceeded USD 3 billion by the end of the US business day. Robust demand from Asia overnight combined with good interest out of Europe with little to no price sensitivity allowed KfW to revise the price guidance to mid swaps +5 bp. The final order book amounted to USD 4.8 billion. Given the quality of the order book KfW was able to price a USD 4 billion transaction late NY morning on September 15, 2010.

The breakdown of the order book by sectors is as follows:

Breakdown by investor type:

Asset Managers: 41%

Central Banks: 37%

Banks: 18%

Others / Corp.: 4%

Geographical Breakdown:

Americas: 39%

Europe: 36%

Asia: 22%

Middle East: 3%

The bond offers the same first class triple-A rating from Fitch Ratings, Moody's and Standard & Poor's as all KfW bonds.

This press release is not an offer of securities for sale in the United States. Securities may not be offered or sold in the United States absent registration or an exemption from registration. KfW has registered the securities that are the subject of this press release for sale in the United States. The offering of the securities in the United States will be made by means of a prospectus that may be obtained from KfW and will contain detailed information about KfW and its management, financial statements and information about the Federal Republic of Germany.

Term Sheet KfW USD IV/2010

USD 4 billion – 1.250% – 2010/2012

ISIN: US500769DT87

Issuer: KfW (Kreditanstalt für Wiederaufbau)

Guarantor: Federal Republic of Germany

Rating: AAA (Fitch Ratings) / Aaa (Moody's) / AAA (Standard &

Poor's)

Size: USD 4,000,000,000.–

Maturity Date: April 22, 2010 – June 15, 2012

Coupon: 1.250% p.a., semi-annual coupon, short first coupon

Payment Dates: June 15 and December 15

Re-offer-Price: 99.86%

Yield: 1.3165% semi-annually

Format: Global

Listing: Luxembourg

Lead Managers (3):

Bank of America / Merrill Lynch

BNP Paribas

HSBC

Co-Lead Managers (10):

Barclays

Credit Suisse

Deutsche Bank

Mitsubishi UFG

Mizuho

Morgan Stanley

Royal Bank of Canada CM

Royal Bank of Scotland

Toronto Dominion

UBS

Media Contact

More Information:

http://www.kfw.deAll latest news from the category: Business and Finance

This area provides up-to-date and interesting developments from the world of business, economics and finance.

A wealth of information is available on topics ranging from stock markets, consumer climate, labor market policies, bond markets, foreign trade and interest rate trends to stock exchange news and economic forecasts.

Newest articles

Bringing bio-inspired robots to life

Nebraska researcher Eric Markvicka gets NSF CAREER Award to pursue manufacture of novel materials for soft robotics and stretchable electronics. Engineers are increasingly eager to develop robots that mimic the…

Bella moths use poison to attract mates

Scientists are closer to finding out how. Pyrrolizidine alkaloids are as bitter and toxic as they are hard to pronounce. They’re produced by several different types of plants and are…

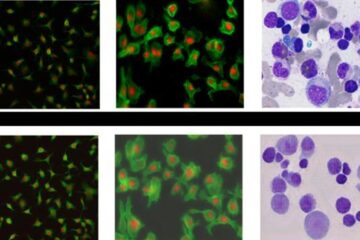

AI tool creates ‘synthetic’ images of cells

…for enhanced microscopy analysis. Observing individual cells through microscopes can reveal a range of important cell biological phenomena that frequently play a role in human diseases, but the process of…