KfW's funding strategy passes 2009 stress test successfully

To fulfil its promotional mandate, KfW Bankengruppe raised nearly EUR 74 billion in the international capital markets in 2009, just as it had announced. The overall environment this year, however, was extraordinarily challenging for big issuers because the capital markets were characterised by high volatility and by very rapid changes in political, economic and monetary policy conditions.

“So I am all the more pleased that KfW has successfully passed the stress test 'Funding in the Financial Market Crisis' as a reliable, transparent and sustainable issuer”, commented Dr Günther Bräunig, member of the Managing Board of KfW Bankengruppe, on the occasion of today's Capital Market Press Conference in Frankfurt. “Our funding strategy has proven itself very well and enabled us to respond flexibly to a changing capital market environment. KfW's first-class credit standing has also contributed to this excellent result”.

KfW is the only issuer of its category to have successfully implemented its offer of liquid benchmark bonds both in EUR and in USD across all benchmark maturities in 2009 – including the 10-year maturity. It has raised EUR 19 billion and USD 21 billion through its Benchmark Programmes, which represent around 47% of the funding volume. “Particularly the subscription of long-term KfW bonds attests to the fundamental trust which investors place in our institution, which they perceive as a 'safe haven'. Well chosen timing and professional execution of the issues are further contributing factors”, added Bräunig.

Bräunig also expressed satisfaction over the fact that KfW was able to win numerous new investors in the crisis year, thus enabling it to further diversify its investor base. On the one hand KfW was able to benefit from German investors' heavier focus on domestic issuers. On the other hand it succeeded in significantly expanding its investor base in the USA. The share of German subscribers to EUR benchmark bonds more than doubled to 34% (2008: around 15%), while the share of US investors in USD global bonds increased to just under 47% (2008: some 27%).

For a global issuer it is extremely important to be firmly anchored in the domestic market and to have a broadly diversified investor base. Having a broad range of currencies and products on offer is crucial. So far this year KfW has placed altogether 412 transactions in 19 different currencies in the market. The most important currencies were the EUR (44%) and the USD (35%), followed by GBP (7%), JPY (4%) and AUD (4%). Overall, some 20% of all issues were in currencies other than EUR and USD. “The financial market crisis has shown that currency and product diversity are the make or break for KfW's funding strategy because it is the only way to flexibly respond to investor needs. This is of strategic importance – not only with a view to funding costs but also to securing our access to liquidity”, explained Bräunig.

KfW will continue to adhere to its successful funding strategy in 2010. Investors can expect more large-volume, liquid KfW benchmark bonds in the core currencies EUR and USD in all maturities, and KfW will respond to market conditions flexibly. Other public bonds in EUR and other currencies as well as private placements will round off the funding mix and give KfW a broad presence as an issuer in the capital markets.

With a view to the funding volume for 2010, KfW expects funding requirements of EUR 70-75 billion.

As a result of fiscal policy and the difficult economic situation, Bräunig expects a high volume of European government bonds to be offered next year. Moreover, the financial market crisis is likely to give rise to further burdens for the real economy and bank debt write-offs, which could delay the further stabilisation of the capital market. On the other hand, however, the state guarantee programmes that were launched across the globe to help banks refinance have largely come to a close. “Uncertainty and volatility will continue to accompany us in our capital market activities in 2010, and even issuers of the highest credit quality like KfW are not immune to difficult market conditions. Yet particularly in the crisis year, there was strong demand for liquid, high-quality investments such as the ones we offer. This is why we are confident about 2010”, he concluded.

The securitisation markets continue to be in a very difficult situation at the end of this year. Although some transactions took place in the course of the year, a functioning, liquid market is still very far away.

Bräunig emphasised that first and foremost it will be necessary for investors to regain trust in this product before it can be utilised again. He is convinced that new quality standards need to be introduced in order to accomplish this. KfW is working on this jointly with other banks and the True Sale Initiative. “High-quality securitisations can play a vital role in securing the supply of credit for enterprises. This, in turn, is crucial for the economy to rebound and for avoiding a credit crunch, which would affect small and medium-sized enterprises most of all”, concluded Bräunig.

For detailed information on KfW's capital market activities click on the menu item “Press” in the English version of KfW's website www.kfw.de.

Media Contact

More Information:

http://www.kfw.deAll latest news from the category: Business and Finance

This area provides up-to-date and interesting developments from the world of business, economics and finance.

A wealth of information is available on topics ranging from stock markets, consumer climate, labor market policies, bond markets, foreign trade and interest rate trends to stock exchange news and economic forecasts.

Newest articles

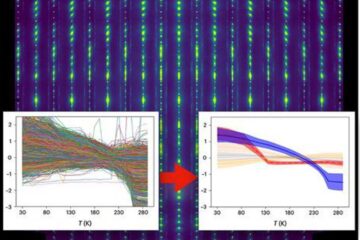

Machine learning algorithm reveals long-theorized glass phase in crystal

Scientists have found evidence of an elusive, glassy phase of matter that emerges when a crystal’s perfect internal pattern is disrupted. X-ray technology and machine learning converge to shed light…

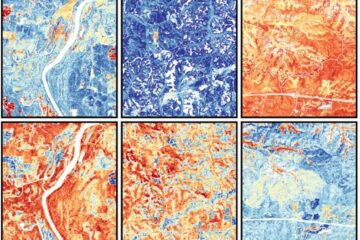

Mapping plant functional diversity from space

HKU ecologists revolutionize ecosystem monitoring with novel field-satellite integration. An international team of researchers, led by Professor Jin WU from the School of Biological Sciences at The University of Hong…

Inverters with constant full load capability

…enable an increase in the performance of electric drives. Overheating components significantly limit the performance of drivetrains in electric vehicles. Inverters in particular are subject to a high thermal load,…