KfW's 10-year Euro Benchmark Bond gets off to flying start

The Euro Benchmark Bond I/2010 matures on 20 January 2020, pays a coupon of 3.625% p.a. and carries a re-offer price of 99.934 (with a 3.633% yield). This corresponds to a yield pick-up of 32.9 bp over the German government bond which matures in January 2020. The transaction was lead managed by Credit Suisse, Deutsche Bank and HSBC. The bond has received the same top-notch ratings (AAA/Aaa/AAA) from Fitch Ratings, Moody's and Standard & Poor's as all KfW bonds.

“Our optimistic expectations at the beginning of the year with regard to the market environment for KfW bonds have been exceeded”, commented Dr Günther Bräunig, member of the Managing Board of KfW Bankengruppe in charge of capital markets. “With our 4 billion US-dollar bond issued on the first trading day of the new year, a 600 million Sterling Bond and this 5 billion EUR Benchmark Bond we had a good start and were able to benefit from the positive appreciation of the Federal Republic of Germany”.

Traditionally, the start of the new year is marked by strong demand from institutional investors, but likewise by a large offer of European government bonds in particular. Within a matter of hours after our order book was opened on Monday, the order volume grew to EUR 5 billion, so the initial price indication in the range of 18 to 20 basis points over the swap curve was adjusted to 18 basis points. On Tuesday morning the order book was closed with a volume of around EUR 8.5 billion.

With a share of around 70% banks and central banks played a decisive role in the bond issue, for which 360 individual orders were ultimately received. The stabilising demand from large central banks, which had already become apparent at the end of 2009, has thus continued.

The breakdown of the order book is as follows:

Breakdown by investor type:

Banks: 57%

Funds: 19%

Central banks: 12%

Insurance companies: 6%

Others: 6%

Geographical breakdown:

Europe: 86%

Germany 54%

Great Britain 12%

France 9%

Switzerland 5%

Benelux 2%

Italy 2%

Other 2%

Asia: 12%

Americas: 2%

For 2010 KfW has announced funding requirements of around EUR 70 to 75 billion. Nearly half of this volume is to be raised through the issuance of large-volume euro and US dollar Benchmark bonds.

This press release is not an offer of securities for sale in the United States. Securities may not be offered or sold in the United States absent registration or an exemption from registration. KfW has registered the securities that are the subject of this press release for sale in the United States. The offering of the securities in the United States will be made by means of a prospectus that may be obtained from KfW and will contain detailed information about KfW and its management, financial statements and information about the Federal Republic of Germany.

Term Sheet

KfW Euro Benchmark I/2010

3.625 % – due 20 January 2020

ISIN: DE000A1CR4S5

Issuer: KfW

Guarantor: Federal Republic of Germany

Rating: AAA (Fitch Ratings)/ Aaa (Moody's) /

AAA (Standard & Poor's)

Size: EUR 5,000,000,000

Maturity: 19 January 2010 – 20 January 2020

Coupon: 3.625 % p.a.

Re-offer price: 99.934

Yield: 3.633 % p.a.

Format: Global Listing: Frankfurt

Lead Manager:

Credit Suisse

Deutsche Bank

HSBC

Senior Co-Lead Manager:

Commerzbank

Deka Bank

DZ Bank

Landesbank Baden-Württemberg

Unicredit (HVB)

Co-Lead Manager:

Banca Akros Gruppo BPM

Barclays

BNP Paribas

BofA Merrill Lynch

Calyon

Citi

Danske Bank A/S

Société Générale Corporate & Investment Banking

Selling Group:

Fortis

ING

Natixis

Nomura

Nordea Bank Danmark A/S

RBC

Santander

SEB

Media Contact

More Information:

http://www.kfw.deAll latest news from the category: Business and Finance

This area provides up-to-date and interesting developments from the world of business, economics and finance.

A wealth of information is available on topics ranging from stock markets, consumer climate, labor market policies, bond markets, foreign trade and interest rate trends to stock exchange news and economic forecasts.

Newest articles

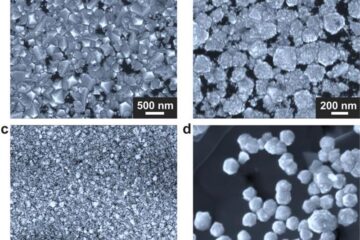

Making diamonds at ambient pressure

Scientists develop novel liquid metal alloy system to synthesize diamond under moderate conditions. Did you know that 99% of synthetic diamonds are currently produced using high-pressure and high-temperature (HPHT) methods?[2]…

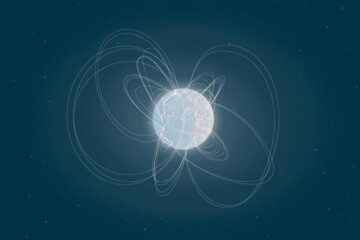

Eruption of mega-magnetic star lights up nearby galaxy

Thanks to ESA satellites, an international team including UNIGE researchers has detected a giant eruption coming from a magnetar, an extremely magnetic neutron star. While ESA’s satellite INTEGRAL was observing…

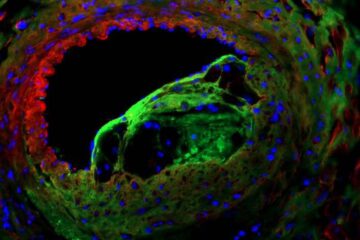

Solving the riddle of the sphingolipids in coronary artery disease

Weill Cornell Medicine investigators have uncovered a way to unleash in blood vessels the protective effects of a type of fat-related molecule known as a sphingolipid, suggesting a promising new…