What Investors Have Learned from the Major Earthquake

1. Introduction

The Great East Japan Earthquake has dramatically altered the way the Japanese economy is seen. For example, the way that housing and real estate values are seen in Japan has changed since 3.11. Location value is what determines the values of homes and real estate. Before the major earthquake, for example, locations for residential areas in the Tokyo metropolitan area with beautiful townscapes were highly appraised, even if they were landfill sites. The preferences of people toward residential areas have greatly changed since 3.11, however. Safety is now more of a concern than factors such as convenience and comfort. Factors such as whether or not there are active faults or the durability of the ground, which had been viewed as relatively unimportant, have all suddenly become important issues. Let us take a look at the psychological changes that have occurred in people’s minds after the major earthquake through stock and housing prices.

2. Major Earthquakes and Stock Prices

May 11, 2011 is the day that a 9-magnitude earthquake struck East Japan. On the following Monday, March 14, the Nikkei average stock price had dropped 6.2%. There was not much else in the news that was significant, and this dropping in stock prices was due to the huge earthquake.

On January 17 sixteen years ago, a 7.2-magnitude earthquake struck the Hanshin-Awaji area. The day that the stock market was affected the most by this earthquake was also the following Monday. On January 23rd, the Nikkei average stock price had dropped 5.6%. There was not much else in the news that was significant, and this dropping in stock prices was also due to the huge earthquake.

The Japanese stock market reacted to these two major earthquakes with up to about 6% drops in stock prices on a daily basis. This can be seen as a universal scale for measuring the level of response that the market has shown to the major earthquakes as unexpected factors.

In the East Japan case, however, there were chain-reaction explosions at the nuclear power plant in Fukushima on March 15. The market immediately reacted to this second unexpected factor, and the Nikkei average dropped 10.6% on that same day. In the Hanshin-Awaji case, there was no such second tragedy, and that is why the point drop range of stock prices one week after the major earthquakes was very different in each of these cases. The Nikkei average dropped only 8.3% at most in the Hanshin-Awaji case, but it dropped as far as 16.8% in the East Japan case.

Interestingly, although the market reacted differently to these two major earthquakes as shown above, the Nikkei average point drop range as of sixteen business days (about three weeks) from the earthquake disasters in both cases showed convergences at about the same levels (about 5% drops).

3. Major Earthquakes and Housing Prices

Markets such as the housing and real estate markets react differently to major earthquakes than the stock market does. Let us examine this while referring to the TSE Home Price Index, which provides monthly changes in the trading prices of used condominiums in the metropolitan area.

In order to understand the effects of major earthquakes, the long-term fluctuations (trends) must be eliminated from housing price fluctuations, and the fluctuations (cycles) that are disassociated from this are to be derived (Figure 1). After the Great Hanshin-Awaji Earthquake, the cycle components of the housing price index of the metropolitan area dramatically dropped for a long period of time (eighteen months). On the other hand, the dropping in prices after the Great East Japan Earthquake was no more than one-tenth of that in the Hanshin-Awaji case.

In the Hanshin-Awaji case, housing price cycles decreased the most eight months after the earthquake disaster so there is a chance that they will decrease the most around November 2011 in the case of the Great East Japan Earthquake. However, the point drop range should be very low when judging from the current situation.

Housing prices in the metropolitan area reacted differently with the two major earthquakes. The following two factors may be the reasons why. The first is the difference in the types of earthquakes that struck. The earthquake in the Hanshin-Awaji type was an inland-type and the earthquake in the East Japan case was a trench-type, and the damages such as destroyed houses are far greater when there are inland-type earthquakes. Furthermore, trends of housing prices already significantly dropped at the time around the Great Hanshin-Awaji Earthquake. In contrast, housing price trends had remained stable at low levels for a long time when the Great East Japan Earthquake occurred.

4. Conclusion – What Investors Have Learned from the Major Earthquake

New levels of stock prices and housing prices suggest the possibility that the Japanese economy is seen in a new and completely different way after the major earthquake. It can be said, however, that the effects on stock prices, housing prices, and so on that the Great East Japan Earthquake had are not so huge when compared with the effects brought upon by the bursting of Japan’s real estate bubble in 1990 or the fall of Lehman Brothers in the autumn of 2008. Figure 2 shows the transitions in stock prices and housing prices in Japan and the US from the bursting of Japan’s real estate bubble to now. The world has seen six rare phenomena including currency crises, fiscal crises, economic bubble collapses, and financial crises during the roughly sixteen years between the Great Hanshin-Awaji and East Japan earthquakes.

The Great East Japan Earthquake once again showed investors that rare circumstances occur frequently. The importance of risk management has been further elevated.

Yuichiro Kawaguchi

Professor, Faculty of Commerce, Waseda University

Born in 1955. Received a Doctorate in engineering from the University of Tokyo in 1991. Founded Real Estate Financial Engineering in 2000 as a new field of study after studying as a Visiting Researcher at the University of Cambridge in 1996. Appointed as Professor on the Faculty of Commerce, Waseda University (Graduate School of Finance, Accounting and Law) in 2004. Research activities include those as Chairman of the Japanese Association of Real Estate Financial Engineering, the Asian Real Estate Society (Vice President as of 2011), and with the American Real Estate and Urban Economics Association. Appointed as Director of the Center for International Real Estate Research, Waseda University in 2007 and Director of the Waseda Institute of Finance in 2010.

Developed a housing price index as Chairman of the Housing Price Index Exploratory Committee of the Ministry of Land, Infrastructure and Transport in 2007 through the Reviews on the Status of Indexes Concerning Trends in the Housing Market report. Serves as a provisional member of the National Property Subcommittee of the Ministry of Finance’s Fiscal System Council, and as Director of the Japan Housing Finance Agency Subcommittee of the Ministry of Finance’s Evaluation Committee for Incorporated Administrative Agencies.

Major publications include Real Estate Financial Engineering [Fudousan Kinyu Kogaku] (Seibunsha, 2000) and Concepts and Skills for Real Options [Riaruopushon No Siko To Gijutu]” (Diamond, Inc., 2004).

Media Contact

All latest news from the category: Business and Finance

This area provides up-to-date and interesting developments from the world of business, economics and finance.

A wealth of information is available on topics ranging from stock markets, consumer climate, labor market policies, bond markets, foreign trade and interest rate trends to stock exchange news and economic forecasts.

Newest articles

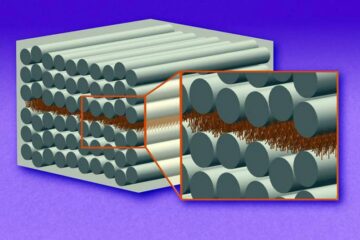

“Nanostitches” enable lighter and tougher composite materials

In research that may lead to next-generation airplanes and spacecraft, MIT engineers used carbon nanotubes to prevent cracking in multilayered composites. To save on fuel and reduce aircraft emissions, engineers…

Trash to treasure

Researchers turn metal waste into catalyst for hydrogen. Scientists have found a way to transform metal waste into a highly efficient catalyst to make hydrogen from water, a discovery that…

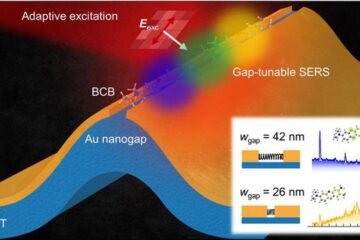

Real-time detection of infectious disease viruses

… by searching for molecular fingerprinting. A research team consisting of Professor Kyoung-Duck Park and Taeyoung Moon and Huitae Joo, PhD candidates, from the Department of Physics at Pohang University…