Insuring Against the Risks of Innovation: a New Way to View Asset Pricing

Commonly, an infusion of innovation implies increased efficiency, productivity, and profits. By nature, innovation also increases competition. Overall production increases while the reverse occurs at companies that do not innovate. In “The Demographics of Innovation and Asset Returns,” financial models determined innovation constitutes a risk factor for asset pricing.

Gârleanu co-authored the paper with Leonid Kogan, professor of management, Massachusetts Institute of Technology and Stavros Panageas, assistant professor of finance, Booth School of Business, University of Chicago.

For example, take Amazon and Barnes & Noble, two competing book and music retailers. As computer technology developed, the birth of the Internet served as a shock of innovation. Amazon, as an innovator built its business online, and outperformed Barnes & Noble. By comparison, Barnes & Noble, which originated as a brick-and-mortar store, took its time to adopt the new technology and sell goods online. As a result, without innovating, Barnes & Noble eventually had to close some of its stores and lay off workers. Gârleanu says the reason why innovation is a risk factor affecting asset prices is that it is not possible to insure oneself against it.

“When innovation is particularly successful, in the context of our model, two things happen. The old firms don’t perform as well and the existing or “old” workers suffer in relative terms,” says Gârleanu. “At the aggregate level, the human-capital risk makes workers reluctant to hold stock of existing firms, since their profits are collectively at risk from new entrants and therefore do poorly precisely when their earning power declines.” The result is both a higher equity premium (low stock prices relative to bond prices) for investors and a lower interest rate in the economy.

Gârleanu adds, “In addition to the implications concerning the general level of the equity premium and the interest rate, the model also implies that firms that benefit from innovation are more desirable, as they hedge against innovation risk, and therefore have high prices, which is the same as low expected returns. These firms are actually known as “growth” firms due to their potential for innovation. One widely observed feature of financial markets is that such firms have high ratios of market prices to book prices, and tend to perform more poorly on average than low market-to-book firms. (These firms are known as “value” firms.) The paper justifies these empirical findings by explaining why growth firms are less risky than value firms.”

“Innovation correlates when growth firms do well, and high innovation is also a measure for workers, “explains Gârleanu, “The reason why the older workers are disadvantaged is because they can’t ‘insure’ themselves against the risk of innovative times.”

The researchers studied an “overlapping-generations economy.” In this model, as in real life, people join the economy over time. A key feature of this model is the premise that those not-yet-born cannot write insurance contracts with current workers agreeing to share the future proceeds of innovation. For instance, if future proceeds are high, they would disproportionately benefit the young workers; if they are low, the older generations would benefit. However, because such an insurance contract is not possible, Gârleanu determined that current workers and companies have to face more risk than there actually is in the economy as a whole.

“If you look at the gross domestic product, when innovation is high, GDP grows. Overall, there is more to consume. However there is a distribution issue when innovation is high, a disproportionate portion of output goes to the innovators, the young people, at the expense of the older people. Overall, it’s good but the distribution is such that part of the population is hurt,” says Gârleanu.

The model does not imply that there is only a small role for experience in the workplace. Certainly, “old” knowledge is still very important in many industries. “We’re looking at the risk. It is precisely when innovation is bigger than average that older workers perform more poorly than younger workers,” says Gârleanu.

In order to test their model, researchers reviewed consumption data over time for people “born” (i.e., entering the workforce) at different points in time, and found that years associated with the birth of young economic agents that did very well throughout their lives coincide with years in which growth firms did well, as the theory predicts.

The paper concludes that the standard aggregate asset pricing model must be augmented to consider by the risk posed by innovation. It suggests that the way to cushion major innovation shocks is investment in growth stocks and potential innovation.

Gârleanu says while the research does not address policy implications, in principle, the government could play a major role in lowering the risk of innovation for older workers by offering some type of mutual insurance where one generation insures another, similar to social security. “A sophisticated tax scheme, for instance, that would take from the innovators and give to the others in high innovation times, respectively take from the older generations and give to the young in low innovation times, could mitigate the risk.”

Nicolae Gârleanu: http://www.haas.berkeley.edu/faculty/garleanu.html

Subscribe to Haas Research Intelligence, the Haas School's quarterly newsletter featuring research news: http://www.haas.berkeley.edu/news/haas-newswire-subscribe.html

Media Contact

All latest news from the category: Business and Finance

This area provides up-to-date and interesting developments from the world of business, economics and finance.

A wealth of information is available on topics ranging from stock markets, consumer climate, labor market policies, bond markets, foreign trade and interest rate trends to stock exchange news and economic forecasts.

Newest articles

Superradiant atoms could push the boundaries of how precisely time can be measured

Superradiant atoms can help us measure time more precisely than ever. In a new study, researchers from the University of Copenhagen present a new method for measuring the time interval,…

Ion thermoelectric conversion devices for near room temperature

The electrode sheet of the thermoelectric device consists of ionic hydrogel, which is sandwiched between the electrodes to form, and the Prussian blue on the electrode undergoes a redox reaction…

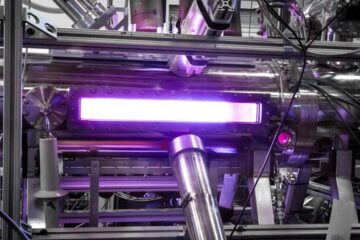

Zap Energy achieves 37-million-degree temperatures in a compact device

New publication reports record electron temperatures for a small-scale, sheared-flow-stabilized Z-pinch fusion device. In the nine decades since humans first produced fusion reactions, only a few fusion technologies have demonstrated…