When good companies do bad things: Examining illegal corporate behavior

MSU’s Yuri Mishina and colleagues argue that unrealistically high pressure on thriving companies increases the likelihood of illegal behavior, as the firms are faced with continuously maintaining or improving their performance.

Previous research suggested high-performing firms are less likely to feel the strains that can trigger illegal activities such as fraud, false claims and environmental and anticompetitive violations.

The MSU-led study, which will appear in a forthcoming issue of the Academy of Management Journal, analyzed 194 large public manufacturing firms in the United States between 1990 and 1999.

“We found that high-performing companies tended not to be able to sustain that high level of performance over time,” said Mishina, assistant professor of management and lead researcher on the project. “At the same time, high performing and highly prominent companies tend to be the ones that are punished most severely for not meeting performance expectations. And so it becomes a choice: Do I cut corners to try to meet these high performance goals and maybe get caught, or do I accept the results of not meeting my performance goals and be punished for sure.”

The pressure comes from both internal and external sources, Mishina said. Internal pressure includes company officials’ perception of how they’re faring against the competition, while external pressure is driven by heightened investor expectations brought about by strong market performance.

The researchers say three factors potentially fuel illegal behavior: loss aversion, or the tendency to prefer avoiding losses above all else; hubris, in which managers come to believe they cannot fail; and the house-money effect, or the concept that people perceive themselves to be gambling with the “house’s money” rather than their own capital.

Mishina said companies are most apt to engage in illegal activity once they become prominent and feel significant public pressure to maintain or improve performance. The research findings also suggest it’s the prospect of poor performance in the future – not the past – that compels firms to break the law.

Thus, regulators should try to monitor the activities of both high- and low-performing firms to detect illegal corporate behavior and consider a firm’s prominence and performance relative to industry peers to determine which firms should receive closer attention, the researchers say.

Mishina also said analysts, investors and company directors need to be careful about how they evaluate firm performance and the pressure they place on management to constantly improve performance.

“Obviously people want their companies to perform well, both from a revenue and profitability standpoint as well as increasing stock prices,” Mishina said. “But this implies we are in some ways missing the idea of what performance should be. Would it be better to think about maybe five-year growth or 10-year growth? Should performance be based on profitability and stock prices or should it be some sort of long-term viability measure that includes creating jobs, stimulating the economy and other factors?

“By focusing completely on fairly short-term financials we’re ignoring a lot of other things,” he added. “And the emphasis on this performance seems to be what’s driving this type of illegal behavior.”

The study is called “Why Good Firms Do Bad Things: The Effects of High Aspirations, High Expectations and Prominence on the Incidence of Corporate Illegality.” It was co-authored by Bernadine Dykes at the University of Delaware, Emily Block at Notre Dame and Timothy Pollock at Penn State.

Michigan State University has been advancing knowledge and transforming lives through innovative teaching, research and outreach for more than 150 years. MSU is known internationally as a major public university with global reach and extraordinary impact. Its 17 degree-granting colleges attract scholars worldwide who are interested in combining education with practical problem solving.

Media Contact

More Information:

http://www.msu.eduAll latest news from the category: Business and Finance

This area provides up-to-date and interesting developments from the world of business, economics and finance.

A wealth of information is available on topics ranging from stock markets, consumer climate, labor market policies, bond markets, foreign trade and interest rate trends to stock exchange news and economic forecasts.

Newest articles

Combatting disruptive ‘noise’ in quantum communication

In a significant milestone for quantum communication technology, an experiment has demonstrated how networks can be leveraged to combat disruptive ‘noise’ in quantum communications. The international effort led by researchers…

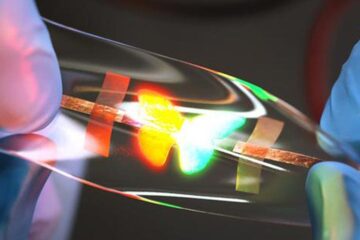

Stretchable quantum dot display

Intrinsically stretchable quantum dot-based light-emitting diodes achieved record-breaking performance. A team of South Korean scientists led by Professor KIM Dae-Hyeong of the Center for Nanoparticle Research within the Institute for…

Internet can achieve quantum speed with light saved as sound

Researchers at the University of Copenhagen’s Niels Bohr Institute have developed a new way to create quantum memory: A small drum can store data sent with light in its sonic…