Financially Wronged? New Study Says Investors Should Go After Leadership Instead of Corporation Itself

Class-action lawsuits against financial companies would often be better aligned with the financial interests of the wronged investor if they were directed at corporate officers and advisors who oversaw questionable practices, rather than the actual corporation as a whole.

That’s one of the conclusions to come from a new paper authored by University of Cincinnati Assistant Professor of Law Lynn Bai, along with fellow law professors James D. Cox of the Duke University School of Law and Randall S. Thomas of the Vanderbilt University Law School. The paper, “Lying and Getting Caught: An Empirical Study of the Effect of Securities Class Action Settlements on Targeted Firms,” was just presented publicly for the first time and will appear in an upcoming edition of the University of Pennsylvania Law Review.

UC Assistant Professor of Law Lynn Bai looked at the impact of class-action suits on financial firms in a new study.

The authors discovered that frequently the long-term damage done to the firm that is sued impacts its viability going forward, a factor that could have negative consequences for investors who are still exposed via their holdings with the company. One way around this would be to target the suit to individuals most at fault – an idea that is more practical than ever in the era of multimillion-dollar compensation packages for high-level financial employees.

“Class actions hurt the reputation of the corporation, distract the attention of the management and, to the extent that settlement is reached, this money may come, at least partially, out of the corporation’s pocket, rather than the pocket of the insurance company,” says Bai.

She adds: “The lawsuit may impose financial distress on the part of the corporation and hurt its financial well-being. From the shareholders' point of view, they have brought the action hoping to be compensated in the form of a large settlement, but they are ultimately the owners of the corporation and, as such, they bear the full negative consequence that the class action may bring to the corporation.”

The new paper by Bai, Cox and Thomas examines two competing views on class-action suits against the current backdrop of consideration of new financial regulation reforms. One traditional school of thought says that the threat of such suits is a necessary deterrent that assures sound practices by financial firms. The other adheres to a deregulatory philosophy that such suits place American companies at a competitive disadvantage in the global financial marketplace while doing little to help the overall position of investors.

Audio clip of Lynn Bai discussing investor impact from lawsuits

The research looked at the impact class-action suits had on 480 companies that were defendants in recent class action suits who had settled the litigation brought against them. Those defendants were compared to companies in the same industries and of similar sizes on key financial parameters such as sales, operating income, liquidity, financial distress levels and stock market performances.

The study revealed evidence of deterioration in the defendants' operating efficiency and short-term liquidity as well as a higher propensity of filing bankruptcy after the lawsuit, relative to their peers. Moreover, stock prices plummeted upon the filing of the lawsuit and had not recovered even years after the lawsuits had been settled.

As one example of the kind of troubles these companies experience, consider what the study showed in regards to increases in risks of bankruptcy.

“The Altman's Z-score is a measure of the overall financial distress level of a company and is widely accepted as a powerful predictor of bankruptcy in the near-future,” Bai says. “We found that our defendents had significantly lower Z-scores than comparable companies that were not involved in class-action lawsuits, which was a new finding.”

Bai also points out that the negative impact might be even stronger than the paper indicates, as the study did not include those similar companies who went bankrupt prior to or at the settlement stage. That is among the questions the researchers hope to look into in the future, as well as issues such as how corporate governance has changed in the wake of class-action suits.

The authors conclude that the research in their paper offers some support to both schools of thought in the debate on the actual useful role of class-action suits, but the data shows undeniable negative impacts for both the corporations in question and, by extension, their shareholders.

“Our results invite thoughts on important legal issues,” Bai says. “For example, if the class actions end up hurting the corporations, shouldn't we adjust our procedural rules such as the pleading standard so as to better guard against frivolous suits? Also, to keep the class action from hurting the corporation, shouldn't the law provide more incentives for shareholders to direct their actions against the officers of the corporation, who actually committed the fraud, rather than the corporation itself?”

Media Contact

All latest news from the category: Business and Finance

This area provides up-to-date and interesting developments from the world of business, economics and finance.

A wealth of information is available on topics ranging from stock markets, consumer climate, labor market policies, bond markets, foreign trade and interest rate trends to stock exchange news and economic forecasts.

Newest articles

Silicon Carbide Innovation Alliance to drive industrial-scale semiconductor work

Known for its ability to withstand extreme environments and high voltages, silicon carbide (SiC) is a semiconducting material made up of silicon and carbon atoms arranged into crystals that is…

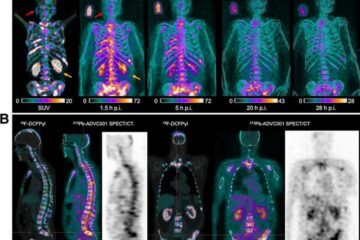

New SPECT/CT technique shows impressive biomarker identification

…offers increased access for prostate cancer patients. A novel SPECT/CT acquisition method can accurately detect radiopharmaceutical biodistribution in a convenient manner for prostate cancer patients, opening the door for more…

How 3D printers can give robots a soft touch

Soft skin coverings and touch sensors have emerged as a promising feature for robots that are both safer and more intuitive for human interaction, but they are expensive and difficult…