Financial Experts Predict Lower Volumes of Distressed Real Estate Loans

The trend of parameters such as gearing ratio, debt maturities, and financing volumes suggest that banks do currently prefer to extend their loans than to dispose of them. At the same time, fewer banks are expanding their new business in the German market.

This is the main outcome of the “Survey on the State of Real Estate Financing and on the Distressed Real Estate Debt Situation in Germany” conducted by the research centre “Distressed Real Estate Debt” jointly operated by CORESTATE Capital AG and the Real Estate Management Institute (REMI) of the EBS Universität für Wirtschaft und Recht.

„The present opportune interest rate is certainly one reason for the low number of distressed real estate portfolios currently on the market. Banks are provided with an abundance of capital since the European Central Bank announced its bond buying program. Therefore, the pressure on banks to sell their non-performing loans has decreased“, explains Ralph Winter, founder of CORESTATE Capital AG. “Nonetheless, distressed real estate assets will continue to be put on the market and their state can only be improved by a professional approach to real estate management, allowing for a stabilisation and repositioning of such portfolios.”

The research focuses on assessing the current financing sentiment in the real estate market from the banks’ perspective. This survey follows last year’s research undertaken by the CORESTATE Research Unit for Distressed Real Estate Debt. „This year's survey shows how significantly the sentiment in the market can change within one year”, says Prof. Dr. Nico B. Rottke, Founder and Head of the Real Estate Management Institute of the EBS University for Economics and Law. „This underpins our plan to repeat the poll on an annual basis. This way we are able to analyse the parameters of the market for distressed real estate assets and assess the significance of non-performing loans.”

Almost 60 leading personalities, such as CEOs, CFOs, and Managing Directors, from 32 commercial real estate financing institutions received the questionnaire. The total assets of the banks participating in the poll add up to approximately € 2,563 bn. representing 72% of all assets from all CRE financers based in Germany. „Our survey shows that the financing landscape is still in a structural change“, emphasises Prof. Dr. Rottke. “Banks continue to implement regulatory measures and impose higher capital requirements or scale back their activities completely.”

The research centre intends to use these findings as a basis for further scientific studies. It is also planned to repeat the poll annually in order to make industry developments and trends transparent and accessible to all stakeholders.

Media Contact

More Information:

http://www.ebs-remi.de/cc_capmarkets/All latest news from the category: Business and Finance

This area provides up-to-date and interesting developments from the world of business, economics and finance.

A wealth of information is available on topics ranging from stock markets, consumer climate, labor market policies, bond markets, foreign trade and interest rate trends to stock exchange news and economic forecasts.

Newest articles

Silicon Carbide Innovation Alliance to drive industrial-scale semiconductor work

Known for its ability to withstand extreme environments and high voltages, silicon carbide (SiC) is a semiconducting material made up of silicon and carbon atoms arranged into crystals that is…

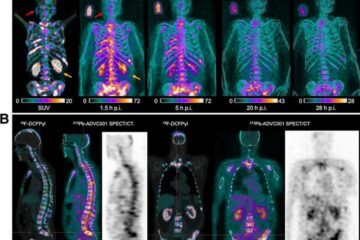

New SPECT/CT technique shows impressive biomarker identification

…offers increased access for prostate cancer patients. A novel SPECT/CT acquisition method can accurately detect radiopharmaceutical biodistribution in a convenient manner for prostate cancer patients, opening the door for more…

How 3D printers can give robots a soft touch

Soft skin coverings and touch sensors have emerged as a promising feature for robots that are both safer and more intuitive for human interaction, but they are expensive and difficult…