Using finance theory to examine the ideal form of corporations and society

Pursuing the social role of the financial industry

Since the 1970s, a time the Modern Theory of Finance finally began to enter Japan, I have conducted research on the role and function of the financial market and financial industry, as well as the social responsibility of the financial industry. At that time, Japanese corporations used mainly indirect financing through bank financing. Unique Japanese systems and customs such as cross-shareholding and main bank systems were deeply rooted. However, there was increasing consciousness regarding the need to establish direct financing and a healthy securities market in Japan.

After receiving my Master’s Degree at graduate school, I entered the Japan Securities Research Institute in 1972. At that time, prominent pioneers of Japanese finance research such as Dr. Shoichi Royama (former professor at Osaka University; deceased), who was a director of the institute, and Dr. Koichi Hamada (former professor at the University of Tokyo) were holding passionate debate both day and night. Their debate focused on how to operate securities markets in Japan, as well as what should be done regarding corporate financing and asset management. Within such an environment, I devoted myself completely to the researching of topics such as price formation in securities markets and the economic function of the securities industry. Such research had little been performed before in Japan, and I studied while translating literature from U.S.A.

Actually, until obtaining my Master’s Degree, I had studied developing economies. At that time, I was considering entering the Doctoral Program to continue my studies in that area. However, when visiting Asian countries in order to participate in international conferences of university students, I witnessed the strong criticism towards Japan’s economic advancement into other countries. As a result, I was deeply troubled by how I should continue my research in economic development. The chance for employment just happened to present itself at that time, and I decided to enter the completely different field , which is finance.

The following year, I entered a Doctoral Program in order to obtain my PhD through finance research while working. At that time, it wasn’t easy to obtain a PhD immediately after completing a Doctoral Program. It was necessary for your doctoral thesis to be published as a book. However, being a woman was a disadvantage when trying to acquire employment at a university, and I realized that I needed an academic degree. I was also raising two children while studying for my PhD, so it was a very trying experience. Although it took 10 years, I was the first one among my graduating class to obtain a PhD. Perhaps my preparation for a tough experience led to my success?!

The theme of my academic thesis was The Japanese Securities Industry: Organization and Competition. Based on industrial organization theory, the thesis summarized the role fulfilled by the securities industry within the financial system. Even so, in the 1980s, a somewhat dirty image was still associated with stockbrokers in the securities industry. I was among the minority at academic conferences when discussing the economic function of the securities industry, such as how the securities industry supports economic society together with the bank system.

Nowadays, the concept of corporate governance by shareholders is commonplace. However, this concept wasn’t discussed much in the 1980s. After all, it wasn’t necessary to consider such issues when soaring economic growth had been continuing ever since the high-growth era after WWII. Afterwards, the Japanese economic bubble burst and earnest reform of the securities market finally began from the end of the 1990s. At the end of the 1990s, there was a loud call for American style of management by shareholder value. The perspective of Japanese corporations towards governance was expected to change to management which prioritized shareholders.

From management by shareholder value to corporate social responsibility

Afterwards, I became a university professor and continued my research. From 1999 to 2000, I spent one year at Oxford University in England as a Visiting Researcher. During this time, I became aware that extensive research was being performed for the extremely important theme of linkage between corporate social responsibility and corporate value. I intuitively felt that this would become a core theme in Japanese capital markets. Instead of focusing on conventional finance, I felt that I should research this new theme which encompassed my interest in the relationship between society and the economy.

Soon afterwards, I wrote a thesis which was based on the theme of ethics and efficiency for the asset management industry. My thesis introduced Japan to the new concept of social responsibility among institutional investors and was published in a book (Frontier of Financial Studies edited by Yoshiro Tsutsui), 4th Chapter; published by Toyo Keizai, 2000). At first glance, ethics and efficiency seem to be conflicting themes. However, I proposed that investment behavior based on ethical imperatives actually leads to fair competition and reliable price formation, thus contributing to market efficiency.

Based on this idea, I conducted research related to investment behavior by the fund managers of institutional investors. Institutional investors in areas such as pension funds are expected to perform asset management by using a long-term perspective to select investments. However, evaluation of fund managers tends to focus on short-term performance. As a result, behavioral bias appears in fund managers, who employ strategies for short-term returns, follow other investors instead of making autonomous decisions and take measures to avoid risk. When engaging in such behavior, it becomes impossible to fulfill the inherent function expected of long-term institutional investors. This negatively affects households and individual investors who are the ultimate providers of funds. Through research surveys (join research with Masashi Toshino) targeting Japanese institutional investors, I exposed trends of such warped investment behavior.

My research was awarded the Outstanding Thesis Prize at an international conference on corporate governance held in 2004 by the University of Birmingham in England. I received offers of joint research from foreign researchers and expanded my work to included international comparative research for Germany, America and Japan. Through such international comparisons, I realized that extremely blatant bias can be observed in Japanese institutional investors when compared with other countries.

If warped behavior is taken by institutional investors who are the main players in securities markets, it means that corporations are not being evaluated appropriately in the securities markets. In order to correct this imbalance, it is necessary to use the broad perspective of financial industry governance in order to thoroughly examine the relationship between short-term profit and long-term profit in investment behavior, as well as the relationship between economic performance and social performance.

In the 2000s, the idea of emphasizing social responsibility in addition to management by shareholder value was slowly implemented in Japan. Instead of prioritizing shareholders only, focus was placed on management which gives balanced priority to relationships with a variety of stakeholders such as consumers, employees and business partners. In theory, such management will increase corporate value and create profits for shareholders in the long term. Although corporate consciousness has changed considerably, the understanding of Japanese corporations towards social responsibility and the form of socially responsible investing still contains many problems from an international perspective.

Social responsibility is intertwined with the governance issue of corporations taking appropriate behavior in order to raise profits in the long term instead of being influenced by short-term gain. Recently, I am conducting research on the relationship between the ownership structure in Japanese corporations and social evaluation. This research examines what kind of shareholders give priority to certain kinds of social evaluation.

elving into the relationship between the economy and society

In the first place, the concept of corporate social responsibility is viewed differently in U.K. and U.S.A. Until now, America has conventionally viewed the relationship between shareholders and managers as an opposing structure. Management by shareholder value is often viewed from the perspective of this American-style governance. As a result, there is a strong implication of social contribution which involves corporations taking some sort of action to benefit society. This created a strongly-rooted view of social responsibility as a waste of corporate assets.

In England, the contrasting view that corporations exist within society is extremely strong. Therefore, corporations have the responsibility of recognizing their influence on society and the needs requested from society. The relationship between shareholders and corporations is not confrontational. Instead, priority is placed on pursuing coordinated value and conducting necessary communication. In order to deepen understanding towards a corporation, it is important for managers to provide sufficient information on corporate management not only to shareholders, but also to society as a whole. This British concept has had a major influence on current corporate responsibility and corporate governance.

Originally, the issue of corporate social responsibility in Japan was addressed by many scholars from fields such as sociology. At first, the involvement of economists in corporate ethics was subject to criticism. Some experts in financial theory actually stated that ethics was unnecessary in finance.

When thinking about my past research, I have always addressed themes in which I found the commonplace to be unreasonable. In order to produce results in new fields, I believe that it is necessary to have strong consciousness and possess a wide variety of interests. Researchers are prone to focusing all their attention on one narrow field. Of course, such an attitude may make it possible to conduct complete and thorough research. However, it prevents growth in research. In reflection, I have always engaged new fields which were not main stream. This is true for both finance and corporate social responsibility. I feel like it was always necessary for me to search for research methods.

In the future, the concept of corporate social responsibility will continue to permeate corporate society in Japan. In the field of finance, it will become increasingly important to delve into the relationship between the economy and society, and to question the ideal form of society. I hope to continue my research while embracing as many new challenges as possible and not interfering with the activities of young researchers!

Media Contact

All latest news from the category: Business and Finance

This area provides up-to-date and interesting developments from the world of business, economics and finance.

A wealth of information is available on topics ranging from stock markets, consumer climate, labor market policies, bond markets, foreign trade and interest rate trends to stock exchange news and economic forecasts.

Newest articles

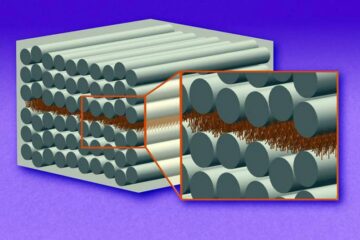

“Nanostitches” enable lighter and tougher composite materials

In research that may lead to next-generation airplanes and spacecraft, MIT engineers used carbon nanotubes to prevent cracking in multilayered composites. To save on fuel and reduce aircraft emissions, engineers…

Trash to treasure

Researchers turn metal waste into catalyst for hydrogen. Scientists have found a way to transform metal waste into a highly efficient catalyst to make hydrogen from water, a discovery that…

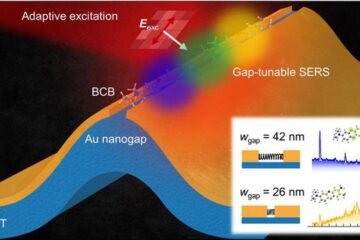

Real-time detection of infectious disease viruses

… by searching for molecular fingerprinting. A research team consisting of Professor Kyoung-Duck Park and Taeyoung Moon and Huitae Joo, PhD candidates, from the Department of Physics at Pohang University…