Fear of Losing Money, Not Spending Habits, Affects Investor Risk Tolerance, MU Study Finds

Now, Michael Guillemette, an assistant professor of personal financial planning in the University of Missouri College of Human Environmental Sciences, along with David Nanigian, an associate professor at the American College, analyzed the causes of risk tolerance and found that loss aversion, or the fear of losing money, is the primary factor that explains investors’ risk tolerance.

“Traditionally, it was believed that spending habits were the main driver of risk tolerance, meaning that the more variation an investor was willing to accept in their spending, the higher their risk tolerance for investments,” Guillemette said.

“Our study found that no such relation exists between risk tolerance and spending habits. Rather, loss aversion is a much more accurate indicator of risk tolerance. The more averse, or fearful, to losing money an investor is, the lower their tolerance seems to be for taking risks in the stock market. Consumer sentiment also appears to help explain investors’ risk tolerance, though not nearly as much as loss aversion.”

For his study, Guillemette, who is also a certified financial planner, analyzed data from a risk tolerance survey taken from 2003-2010. Guillemette focused on three potential drivers of risk tolerance: loss aversion, changes in investor spending habits and changes in consumer sentiment levels.

Guillemette says it is important for risk assessment instruments to measure loss aversion, especially during times when the stock market is performing poorly. He says knowing how much investors are willing to risk at the worst of times is valuable for financial planners tasked with creating long-term investment plans.

“Financial planners probably acquire more accurate information on client risk preferences when risk tolerance is assessed in a hot state when stock prices are falling, compared to a cold state, when stock prices are rising,” Guillemette said.

“Now that we know loss aversion is a key factor that drives risk tolerance, it is important for investors to take steps to reduce their loss averse tendencies. This includes viewing investment returns infrequently, as investors allocate a greater percentage of their portfolio to stocks if they view their returns on an annual, as opposed to monthly, basis.”

Guillemette says that encouraging investors to view their portfolios in a holistic manner also will help reduce loss aversion. Finally, he says research has shown that financial planners with the Certified Financial Planner™ designation can help increase investor certainty during periods of market turmoil.”

This study is forthcoming in the Financial Services Review.

Editor’s Note: Guillemette pronounces his name “Gill-uh-met”.

Media Contact

All latest news from the category: Business and Finance

This area provides up-to-date and interesting developments from the world of business, economics and finance.

A wealth of information is available on topics ranging from stock markets, consumer climate, labor market policies, bond markets, foreign trade and interest rate trends to stock exchange news and economic forecasts.

Newest articles

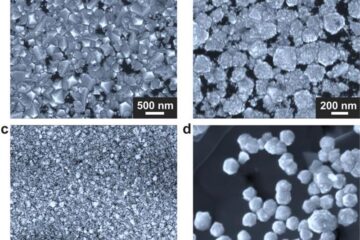

Making diamonds at ambient pressure

Scientists develop novel liquid metal alloy system to synthesize diamond under moderate conditions. Did you know that 99% of synthetic diamonds are currently produced using high-pressure and high-temperature (HPHT) methods?[2]…

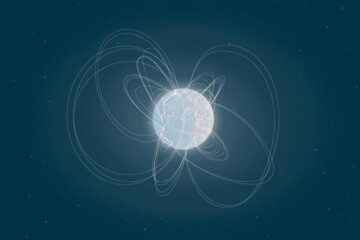

Eruption of mega-magnetic star lights up nearby galaxy

Thanks to ESA satellites, an international team including UNIGE researchers has detected a giant eruption coming from a magnetar, an extremely magnetic neutron star. While ESA’s satellite INTEGRAL was observing…

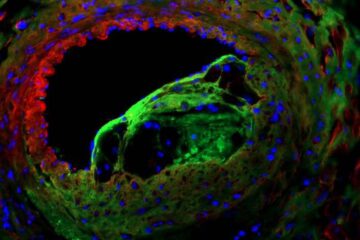

Solving the riddle of the sphingolipids in coronary artery disease

Weill Cornell Medicine investigators have uncovered a way to unleash in blood vessels the protective effects of a type of fat-related molecule known as a sphingolipid, suggesting a promising new…