Encore of corporate tax holiday unlikely to stimulate economy

Dhammika Dharmapala, a professor of law at Illinois, says that while the idea of a tax holiday has found favor among some politicians and presidential hopefuls looking to jolt the country out of the financial doldrums, it would have little positive effect on economic growth.

“Ostensibly, the aim is to increase domestic investment and employment – that is, to induce firms to buy more machinery or hire more workers and the like,” Dharmapala said. “However, the firms that repatriated money from abroad in 2005 tended not to increase domestic investment and employment levels. So to try the same thing again and expect a different result might be described as a triumph of hope over experience.”

The 2005 tax holiday, which was a result of the American Job Creation Act of 2004, allowed firms to repatriate cash from abroad and pay only 5 percent in tax.

“The U.S. corporate tax rate is 35 percent, reduced by the amount of foreign tax a firm pays,” Dharmapala said. “To pay only 5 percent tax creates a very large incentive for firms to bring cash back, and they responded by bringing back over $300 billion.”

So what happened to all that repatriated cash?

“It resulted in the repurchase of shares, so that cash was returned to shareholders,” Dharmapala said. “One could argue that it might be better to have that cash in the hands of shareholders than have it stay abroad, but it certainly didn't boost the economy. Most shareholders were probably not constrained in their consumption activities to begin with in 2005, so I wouldn't expect anything different this time around.”

Since Congress didn't create any sort of tracing rules nor require incremental spending of the repatriated cash, Dharmapala says the tax holiday of 2005 became a textbook example of the fungible nature of money.

“If a firm was planning to spend $100 million on domestic investment, they could designate $100 million brought back from abroad as that money, which then frees up some other $100 million to repurchase shares,” he said. “As long as the amount firms brought back doesn't exceed domestic investment, it's difficult to design a rule that could bypass that problem. Moreover, the laws that Congress passes about repatriation taxes cannot fundamentally affect the set of investment opportunities available to firms. Even if such measures are completely effective in their aims, they would create the problem of forcing firms to engage in unprofitable investments.”

According to Dharmapala, the revived proposals for another tax holiday – even though the 2005 holiday was sold to legislators and the public as a one-time event – reflect ongoing concerns about high levels of unemployment and the perceived lack of investment by firms in the U.S.

“The problem is that we don't really know why firms aren't investing right now,” he said. “By historical standards, firms are sitting on a lot of cash, so it's difficult to see why their investment behavior would change simply by giving them less costly access to their foreign cash.”

Ironically, one of the unintended consequences of the 2005 tax holiday is that it may have actually increased the amount of foreign cash holding, Dharmapala said.

“It created the expectation that there would be future tax holidays,” he said. “So firms started stockpiling cash abroad – in some cases, even more cash than they normally would have – all over again in anticipation of future tax holidays.”

Although it's difficult to predict whether there is enough political momentum for another tax holiday, Dharmapala notes the potential trade-off between long-term tax reforms and short-term stimulus measures.

“Another short-term tax holiday may undermine these long-term goals,” he said.

Media Contact

More Information:

http://www.illinois.eduAll latest news from the category: Business and Finance

This area provides up-to-date and interesting developments from the world of business, economics and finance.

A wealth of information is available on topics ranging from stock markets, consumer climate, labor market policies, bond markets, foreign trade and interest rate trends to stock exchange news and economic forecasts.

Newest articles

Combatting disruptive ‘noise’ in quantum communication

In a significant milestone for quantum communication technology, an experiment has demonstrated how networks can be leveraged to combat disruptive ‘noise’ in quantum communications. The international effort led by researchers…

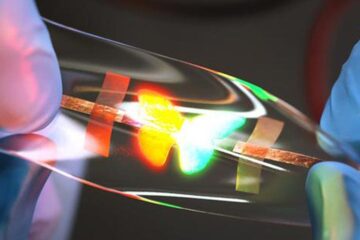

Stretchable quantum dot display

Intrinsically stretchable quantum dot-based light-emitting diodes achieved record-breaking performance. A team of South Korean scientists led by Professor KIM Dae-Hyeong of the Center for Nanoparticle Research within the Institute for…

Internet can achieve quantum speed with light saved as sound

Researchers at the University of Copenhagen’s Niels Bohr Institute have developed a new way to create quantum memory: A small drum can store data sent with light in its sonic…