Crises lead banks to operate more opportunistically

During the 1990s financial crisis, Swedish banks were criticised in the media for causing unnecessary corporate bankruptcies through, for example, increased collateral requirements and unexpected credit cancellations. Questions, similar to those being raised today, were raised about the morality of bank behaviour.

“Credit relationships between banks and their clients are based both on formal, written credit agreements and informal understandings and accords,” explains Kristina Furusten of the Department of Business Studies. “Clients are presumed to operate opportunistically at the expense of the banks, but not vice versa.”

As Kristina Furusten shows in her dissertation, however, banks did behave opportunistically during the 1990s financial crisis. They breached verbal agreements more often than had been usual and altered the practices that governed their relationships with clients. They took more frequent recourse to the terms of written agreements, which they interpreted more strictly than they had prior to the financial crisis. Their relationships with clients assumed a more formal character, and the psychological climate changed. The actions of bank office managers and loan officers were more tightly controlled by bank rules, and major bank reorganisations occurred. Many clients were assigned new officers at centralised insolvency departments, leaving them feeling anonymous and illtreated. Companies with financial difficulties faced poorer prospects for obtaining support from their banks.

“The conclusion is that contractual relationships are characterised by mutual opportunism when banks find themselves in crisis situations,” says Kristina Furusten.

Strong external pressure from such sources as the state, the financial supervisory authority and rating institutes prompts banks to make a clear break with previous practices as a way of restoring their credibility. Significant pressure is also brought to bear on individual bank employees, causing them to fear making decisions that they might subsequently be called on to defend.

“Individual companies need to appreciate that their agreements with banks are dynamic, that the conditions are subject to change over time and that banks always have the advantage when it comes to interpretation,” says Kristina Furusten.

She defended her dissertation on 17 September.

For additional information, please contact Kristina Furusten, +46-(0)155-28 59 20 or +46-(0)70-606 72 48, e-mail: Kristina.Furusten@fek.uu.se

Media Contact

All latest news from the category: Business and Finance

This area provides up-to-date and interesting developments from the world of business, economics and finance.

A wealth of information is available on topics ranging from stock markets, consumer climate, labor market policies, bond markets, foreign trade and interest rate trends to stock exchange news and economic forecasts.

Newest articles

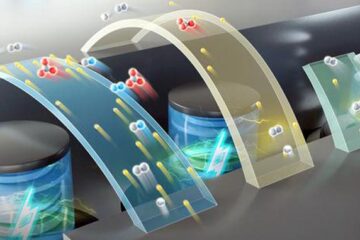

High-energy-density aqueous battery based on halogen multi-electron transfer

Traditional non-aqueous lithium-ion batteries have a high energy density, but their safety is compromised due to the flammable organic electrolytes they utilize. Aqueous batteries use water as the solvent for…

First-ever combined heart pump and pig kidney transplant

…gives new hope to patient with terminal illness. Surgeons at NYU Langone Health performed the first-ever combined mechanical heart pump and gene-edited pig kidney transplant surgery in a 54-year-old woman…

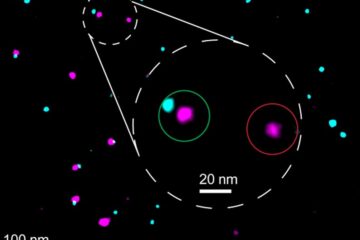

Biophysics: Testing how well biomarkers work

LMU researchers have developed a method to determine how reliably target proteins can be labeled using super-resolution fluorescence microscopy. Modern microscopy techniques make it possible to examine the inner workings…