Controlling for the weather: Hedging increases firm value, new study shows

Hedging refers to insuring against extreme fluctuations in the prices or quantities of commodities/securities.

In “Risk Management and Firm Value: Evidence from Weather Derivatives,” forthcoming in the Journal of Finance, co-author Hayong Yun, an assistant professor of finance in Notre Dame's Mendoza College of Business, examines the impact of financial innovation on firm value, investment, and financing decisions. Specifically, the research examines the effect of the introduction of weather derivatives on electric and gas utilities, arguably some of the most weather-exposed businesses in the economy.

Using stock market and financial statement data on 203 companies from 1960 to 2007, the researchers show the utilities most likely to use weather derivatives are those with the greatest cash flow sensitivity to weather. Those that do make use of the derivatives, significantly decrease the volatility of their cash flows, which in turn increase debt borrowings, investments and ultimately their share prices.

Yun says there has been much theoretical research on why hedging can have an impact on increasing firm value, but actually proving such is challenging, largely because firms do not randomize their hedging decisions.

“Our research tries to overcome this endogeneity, or non-random choice of hedging, by comparing examples with and without the possibility of hedging, specifically focusing on utilities heavily exposed to weather risk,” Yun says. “For example, utilities in San Diego where weather is always mild and predictable, and in Minnesota, where weather varies greatly from year-to-year, have different weather risk exposure. Before 1997, we believe San Diego utilities enjoyed smoother cash flow than those in Minnesota.

However, after 1997, this weather risk-driven advantage began to disappear because utilities in harsher climates could buy weather derivatives to financially hedge weather risk.”

Why do firm values increase when cash flows are smoothened?

“It is partially explained by investment and tax benefits,” Yun says. “Banks are reluctant to lend when a company's cash flow is low, hence, companies may be forced to pass up valuable investment projects during those times. Also, by borrowing debt, there is an added benefit of tax exemption for the interest payments.”

Yun, who teaches corporate governance, also is an expert in corporate finance, law and economics, bankruptcy, and contract theory.

Media Contact

More Information:

http://www.nd.eduAll latest news from the category: Business and Finance

This area provides up-to-date and interesting developments from the world of business, economics and finance.

A wealth of information is available on topics ranging from stock markets, consumer climate, labor market policies, bond markets, foreign trade and interest rate trends to stock exchange news and economic forecasts.

Newest articles

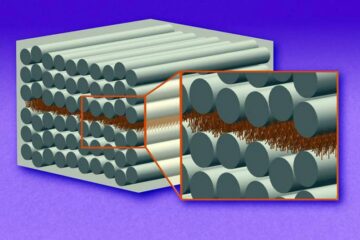

“Nanostitches” enable lighter and tougher composite materials

In research that may lead to next-generation airplanes and spacecraft, MIT engineers used carbon nanotubes to prevent cracking in multilayered composites. To save on fuel and reduce aircraft emissions, engineers…

Trash to treasure

Researchers turn metal waste into catalyst for hydrogen. Scientists have found a way to transform metal waste into a highly efficient catalyst to make hydrogen from water, a discovery that…

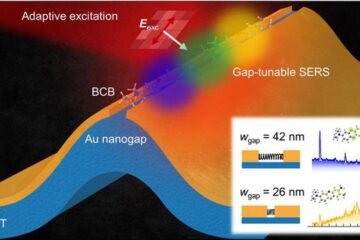

Real-time detection of infectious disease viruses

… by searching for molecular fingerprinting. A research team consisting of Professor Kyoung-Duck Park and Taeyoung Moon and Huitae Joo, PhD candidates, from the Department of Physics at Pohang University…