Continued weak earnings in Swiss Private Banking

In addition, successful measures against tax evasion as well as tightening regulatory rules have intensified global competition. Swiss private bankers are painfully aware of these issues and the resulting decline in revenues and stagnation in costs. In particular, small-sized Swiss institutions report high cost/income ratios. Nevertheless, Swiss wealth managers were successful in acquiring new client assets in 2010. This is demonstrated in the latest edition of “The International Private Banking Study”, published by the Department of Banking and Finance of the University of Zurich.

The tightening of regulatory rules and the strong efforts by various governments and international organizations to fight tax evasion have left clear marks on the international private banking industry. Traditional offshore centers, such as Switzerland or Liechtenstein, have suffered from a strong decline in wealth management revenues and, as a consequence, from increasing cost/income ratios. Among the nine countries and regions analyzed, Swiss private banks were the least efficient with an average cost/income ratio of 77 per cent in 2010. This represents a worsening of 17 percentage points when compared to 2007.

Size is not the only criterion for success

An in-depth comparison of small (Assets under management 10bn CHF) Swiss wealth managers reveals that small banks are on average less efficient than their larger competitors. This does, however, not necessarily imply that banks having less than 10bn CHF in AuM are uncompetitive per se. Evidence was found that, in terms of cost/income-ratio, a select few small sized banks are easily holding up with their large competitors. “These banks follow a business model that allows for a healthy balance between revenues and costs and therefore guarantee a sustainable cost/income ratio”, Prof. Birchler of the Department of Banking and Finance points out. Outsourcing of non-core business activities can thereby play an important role. “Banks that manage (or have managed) to successfully adapt their individual business model to the new environment will secure a promising starting position in a challenging market”, Prof. Birchler adds. Given the wide range of sourcing options and geo-strategic alternatives, size will thereby remain only one of many determinants of success.

Increasingly demanding clients, lower margins

“The continuing deterioration of margins over the past years is remarkable”, Prof. Dr. Urs Birchler, the head of the study, explains. Adjusted gross margins on assets under management have dropped by 21 per cent from 2004 to 2010 and across the entire sample. According to Prof. Birchler, causes for this development are manifold; for instance, clients have become more risk-conscious and performance-oriented. Enhanced transparency in the financial product universe and numerous attempts to simplify the comparison of products, services and prices have increased client’s understanding of the business and thereby strengthened its bargaining power. In many international oriented wealth management centers, such as Switzerland, traditional offshore clients have given way to a new generation of tax compliant and highly sophisticated clients who seek individual and comprehensive advice. “Given these facts, it is unlikely that the margins will increase in the near future”, Prof. Birchler explains.

Net new money inflows in 2010

In 2009, pressure on banking secrecy and severe political tensions between the Swiss financial center and foreign tax authorities led to significant net new money outflows from Swiss private banks. In 2010, however, Swiss wealth managers were able to attract net new money in the amount of 49 Billion CHF. This development was – at least partially – driven by the strong devaluation of the Euro and the worsening of the sovereign debt crisis in Europe. “These findings illustrate that, in relative terms, the political and economic stability of Switzerland is still perceived as such in turbulent times, thus underpinning Switzerland’s save haven status”, Prof. Birchler concludes.

About the Study

209 financial institutions focused on private wealth management were analyzed for their respective performance in 2009 and 2010. The sample contains banks from Austria, the Benelux countries, France, Germany, Italy, Liechtenstein Switzerland, the UK and the US. The objective is to compare the relative strengths and the competitiveness of wealth managing banks over all countries by measuring various key performance ratios. In this year’s study particular emphasis is laid on the Swiss sample.

The study was performed with the financial support from the Association of Swiss Commercial and Investment Banks (VHV/BCG). It represents the fifth issue of the „The International Private Banking Study“ previously published in 2009, 2007, 2005 and 2003.

The study is available free of charge on: www.bf.uzh.ch/go/pbs

Contacts:

Prof. Dr. Urs Birchler

University of Zurich

Department of Banking and Finance

Tel. +41 44 634 29 52

E-Mail: urs.birchler@bf.uzh.ch

Daniel Ettlin

University of Zurich

Department of Banking and Finance

Tel. +41 44 634 31 59

E-Mail: daniel.ettlin@bf.uzh.ch

Media Contact

More Information:

http://www.uzh.chAll latest news from the category: Business and Finance

This area provides up-to-date and interesting developments from the world of business, economics and finance.

A wealth of information is available on topics ranging from stock markets, consumer climate, labor market policies, bond markets, foreign trade and interest rate trends to stock exchange news and economic forecasts.

Newest articles

Combatting disruptive ‘noise’ in quantum communication

In a significant milestone for quantum communication technology, an experiment has demonstrated how networks can be leveraged to combat disruptive ‘noise’ in quantum communications. The international effort led by researchers…

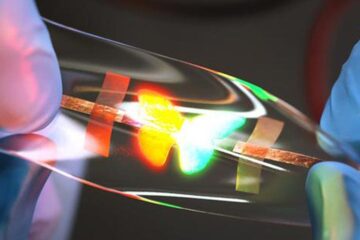

Stretchable quantum dot display

Intrinsically stretchable quantum dot-based light-emitting diodes achieved record-breaking performance. A team of South Korean scientists led by Professor KIM Dae-Hyeong of the Center for Nanoparticle Research within the Institute for…

Internet can achieve quantum speed with light saved as sound

Researchers at the University of Copenhagen’s Niels Bohr Institute have developed a new way to create quantum memory: A small drum can store data sent with light in its sonic…