Chinese Americans Don’t Over Borrow, MU Study Finds

Bad mortgage loans and rampant consumer debt were two of the primary causes for the recent economic recession in the U.S. Despite a national trend of debt problems, a University of Missouri researcher has found one American population that holds almost no consumer debt outside of typical home mortgages.

Rui Yao, an assistant professor of personal financial planning in the College of Human Environmental Sciences at the University of Missouri, found that while 72 percent of Chinese-American households hold a mortgage, only five percent of those households have outstanding auto loans, and only three percent have any other type of consumer debt.

In her study, Yao surveyed Chinese-American households in ten Midwestern cities. Income levels of participants ranged from $4,000 to $1.4 million annually with an average income of $106,000. She found that despite a low overall rate of debt, Chinese-American households with higher incomes were more likely to have some type of consumer debt.

“This result may reflect some unique aspects of the Chinese culture,” Yao said. “Credit and debt are relatively new concepts to the Chinese. Having ties to a country where most purchases are made with cash, debt may not be an acceptable option for low- income households that are aware that debt needs to be repaid with interest in the future. It may also be that high levels of debt for those with relatively higher income reflect relatively higher mortgage balances.”

Yao says that while the Chinese-American population is the largest Asian-American group in the U.S., many have little experience in the American economy. She believes Chinese Americans could benefit from financial education designed to help them plan for their financial future in a manner consistent with Chinese cultural values. Yao believes encouraging Chinese Americans to take advantage of debt in a responsible fashion is important for the entire U.S. economy.

“The historic aversion of the Chinese to debt could be both a strength and a weakness in the U.S. economy,” Yao said. “It is a strength because it enables them to build a strong financial base that is not threatened by excessive amounts of consumer debt or subject to loss in uncertain financial times. However, it may be a weakness if it limits consumption. Appropriate use of debt can help households improve their quality of life as well as spur economic growth through an increase in market purchases. At the same time, excessive debt can become a financial burden to households and lenders, as proven by the recent sub-prime lending crisis.”

This study was published in the Journal of Family Economic Issues.

Media Contact

More Information:

http://www.missouri.eduAll latest news from the category: Business and Finance

This area provides up-to-date and interesting developments from the world of business, economics and finance.

A wealth of information is available on topics ranging from stock markets, consumer climate, labor market policies, bond markets, foreign trade and interest rate trends to stock exchange news and economic forecasts.

Newest articles

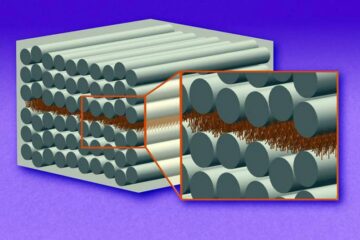

“Nanostitches” enable lighter and tougher composite materials

In research that may lead to next-generation airplanes and spacecraft, MIT engineers used carbon nanotubes to prevent cracking in multilayered composites. To save on fuel and reduce aircraft emissions, engineers…

Trash to treasure

Researchers turn metal waste into catalyst for hydrogen. Scientists have found a way to transform metal waste into a highly efficient catalyst to make hydrogen from water, a discovery that…

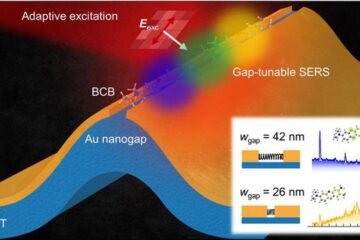

Real-time detection of infectious disease viruses

… by searching for molecular fingerprinting. A research team consisting of Professor Kyoung-Duck Park and Taeyoung Moon and Huitae Joo, PhD candidates, from the Department of Physics at Pohang University…