Bursting The Bubble: Economists Suggest Gold Investments Are Risky

The federal deficit and a deteriorating economy have many investors fearful of the United States economy entering a period of stagnation, causing stock prices to be driven downward, said Lloyd Thomas, an economics professor at Kansas State University. In this period of uncertainty, many are selling stocks and corporate bonds and putting their money into gold.

Recently, gold prices have skyrocketed as high as $1,800 an ounce, and Thomas said the price might continue to creep higher as economic concern grows. “People believe that gold is a hedge against uncertain times,” he said. “In the long run, gold prices have kept pace with inflation. People are flocking to it.”

Other financial experts agree, citing a perceived security in tangible investments during uncertain times. Ann Coulson, an instructor for Kansas State University's personal financial planning program, said that the weakened U.S. dollar and real estate market, “wild ride” of the stock market and low interest rates have caused many investors to turn to gold.

“Where to invest has become a question for many, and gold has risen to the top for some investors,” Coulson said.

Coulson said there are many ways individuals may choose to invest in gold, including jewelry, coins, bullion or gold bars, exchange traded funds, gold mining stocks, gold mutual funds and gold futures and options. Jewelry and coins are typically not good choices, she said, and gold bars raise many storage and cost issues. Exchange traded funds give the investor the opportunity to own gold without an actual delivery, and gold mining stocks' value is only partially dependent on the value of gold.

Diversified investment — like gold mutual funds — often offer the most protection, Coulson said.

“Gold futures and options are not for the novice investor,” she said. “Investing in gold through an infomercial on late-night TV is also a bad idea.”

Both Coulson and Thomas agreed that the price of gold may continue to rise, but cautioned that the increase most likely will not last. From 1960 to the present, Thomas said, gold has gone up an average of 8 percent a year, while inflation rose at less than 4 percent a year. In the last 10 years, gold has gone up 17 percent a year.

“In the long run, gold has gone up,” Thomas said. “But in 2000 the price of gold was $300 an ounce. It has gone up six-fold since then, and it might go up higher than what it is right now. It's gone up too fast — it's a bubble.”

Thomas compared his gold predictions to the housing market. People were lulled into thinking housing prices could never fall, but they fell more than 30 percent in most American cities.

“The same thing could happen to gold; it's not risk-free,” he said. “In the last 10 years it's gone up 17 percent a year, but the price of things we purchase has only gone up 3 percent a year. That's unsustainable. It's my own opinion that gold prices will collapse — I just don't know when.”

Although the price of gold is high, it may be a good investment as the price continues to climb — for now. Unlike investing in stocks or bonds, Coulson said, there is no income associated with gold. Money is made from buying low and selling high. She agreed that the price is destined to fall at some point.

“Gold as a piece of a diversified portfolio might make sense, but if an investor invests solely in gold, that is a great risk,” she said. “It is not a safe investment unless you are buying gold bars and burying them in your backyard, and even that is not safe because the price is dictated by what buyers are willing to pay for gold.”

Thomas suggested that the only way to make a gold investment virtually risk-free is to look at it as a long-term investment since, in the long run, gold prices do tend to go up. As a 50-year investment gold may be a safe bet, he said, but it is not a guarantee in the short-term.

“On a 100-year horizon, sure — buy gold and leave it to your grandchildren,” he said. “But in two, five or 10 years, prices could be lower than they are now. There's a lot of fluctuation. Prices have gone from $200 an ounce to $1,800. That just can't continue.”

As the federal government attempts to pay interest on its growing debt, Thomas said the chances for increased inflation will go up. As this happens, gold prices may continue to fluctuate as investors pull money out of stocks. However, as the deficit slowly decreases, gold prices could fall in half.

“When investors become more confident in the economy, gold will be less valuable as an investment,” Coulson said. “I agree with Warren Buffett: Gold has no utility, so as a long-term investment it's not a good choice.”

Lloyd Thomas, 785-532-4584, lbt@k-state.edu;

and Ann Coulson, 785-532-5510, lcoulso1@k-state.edu

Media Contact

More Information:

http://www.k-state.eduAll latest news from the category: Business and Finance

This area provides up-to-date and interesting developments from the world of business, economics and finance.

A wealth of information is available on topics ranging from stock markets, consumer climate, labor market policies, bond markets, foreign trade and interest rate trends to stock exchange news and economic forecasts.

Newest articles

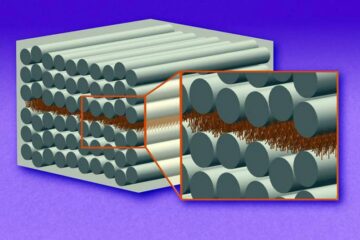

“Nanostitches” enable lighter and tougher composite materials

In research that may lead to next-generation airplanes and spacecraft, MIT engineers used carbon nanotubes to prevent cracking in multilayered composites. To save on fuel and reduce aircraft emissions, engineers…

Trash to treasure

Researchers turn metal waste into catalyst for hydrogen. Scientists have found a way to transform metal waste into a highly efficient catalyst to make hydrogen from water, a discovery that…

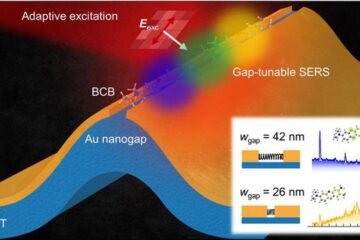

Real-time detection of infectious disease viruses

… by searching for molecular fingerprinting. A research team consisting of Professor Kyoung-Duck Park and Taeyoung Moon and Huitae Joo, PhD candidates, from the Department of Physics at Pohang University…