Angel Investors Flee Seed and Start-Up Stage in First Half of 2010

According to the analysis, “The Angel Investor Market in Q1Q2 2010: Where Have All the Seed Investors Gone?”, total investments in the first half of 2010 were $8.5 billion, a decrease of 6.5 percent over the first half of 2009.

A total of 25,200 entrepreneurial ventures received angel funding in the first half of 2010, a 3 percent increase from the same period in 2009, and the number of active investors in the period was 125,100 individuals, a drop of 11 percent from the same period in 2009. The decline in total dollars, coupled with the small increase in investments, resulted in a 9 percent decline in deal size for the first and second quarters of 2010 compared with 2009.

“These data indicate that while angels remain committed to this investment class they do so with a cautious approach to investing. Angels are committing fewer dollars in more deals, a result of the lower valuations. While the market exhibited a stabilization from the first half of 2009, when compared to the market correction that occurred in 2008, these data indicate that the angel market appears to have reached its nadir in 2009,” said Jeffrey Sohl, director of the UNH Center for Venture Research at the Whittemore School of Business and Economics.

According to Sohl, angels have decreased their appetite for seed and start-up stage investing, with 26 percent of Q1 and Q2 2010 angel investments in the seed and start-up stage, marking a steady decrease in the seed and start-up stage that began in 2008 (45 percent) and 2009 (35 percent). This is the smallest percentage in seed and start-up investing for several years, a decline reflected in an increase in post-seed/start-up investing with 56 percent of investments in this stage.

“Historically angels have been the major source of seed and start-up capital for entrepreneurs, and this declining interest in seed and start-up capital represents a significant change in the angel market. Without a reversal of this trend in the near future, the dearth of seed and start-up capital may approach a critical stage, deepening the capital gap and impeding both new venture formation and job creation. This change in investment behavior is likely an indication of both a need to increase investments in existing portfolio companies in order for these portfolio companies to survive the recession and an extended exit horizon,” Sohl said.

Healthcare services/medical devices and equipment accounted for the largest share of investments, with 24 percent of total angel investments in Q1 and Q2 2010, followed by biotech (20 percent), software (12 percent), industrial/energy (11 percent), which reflects a continued appetite for green technologies, retail (9 percent) and media (5 percent). Retail and media have solidified their presence in the top six sectors, mainly due to a continued interest in social networking ventures.

In the first half of 2010, 65 percent of the membership in angel groups was latent angels — individuals who have the necessary net worth, but have not made an investment — which is an increase from 2009 (54 percent) and 2008 (36 percent).

“This significant percentage of latent investors indicates that while many high net worth individuals may be attracted to angel groups, they have not converted this interest into direct participation. This increase in latent angels may be the result of the longer exit horizon and, in general, be indicative of the lack of seed capital and the need for research to move the latent angel to the active investor,” Sohl said.

The Center for Venture Research has been conducting research on the angel market since 1980. The center’s mission is to provide an understanding of the angel market and the critical role of angels in the early stage equity financing of high growth entrepreneurial ventures. Through the tenet of academic research in an applied area of study, the center is dedicated to providing reliable and timely information on the angel market to entrepreneurs, private investors and public policymakers. For more information visit http://wsbe.unh.edu/cvr or contact the center at 603-862-3341.

The University of New Hampshire, founded in 1866, is a world-class public research university with the feel of a New England liberal arts college. A land, sea, and space-grant university, UNH is the state's flagship public institution, enrolling more than 12,200 undergraduate and 2,200 graduate students.

The Q1 and Q2 2010 Angel Market Analysis is available at http://www.unh.edu/news/docs/CVRQ1Q210.pdf

Media Contact

More Information:

http://www.unh.eduAll latest news from the category: Business and Finance

This area provides up-to-date and interesting developments from the world of business, economics and finance.

A wealth of information is available on topics ranging from stock markets, consumer climate, labor market policies, bond markets, foreign trade and interest rate trends to stock exchange news and economic forecasts.

Newest articles

Bringing bio-inspired robots to life

Nebraska researcher Eric Markvicka gets NSF CAREER Award to pursue manufacture of novel materials for soft robotics and stretchable electronics. Engineers are increasingly eager to develop robots that mimic the…

Bella moths use poison to attract mates

Scientists are closer to finding out how. Pyrrolizidine alkaloids are as bitter and toxic as they are hard to pronounce. They’re produced by several different types of plants and are…

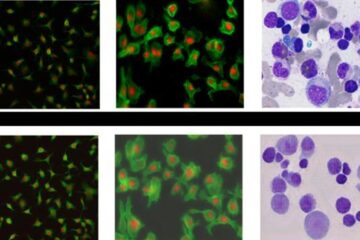

AI tool creates ‘synthetic’ images of cells

…for enhanced microscopy analysis. Observing individual cells through microscopes can reveal a range of important cell biological phenomena that frequently play a role in human diseases, but the process of…