If a fat tax is coming, here’s how to make it efficient, effective: ISU economists

With a national debate taking shape about the possibility of a national tax on foods with high sweetener content, ISU economists have examined how such a tax would best be applied.

Rather than assessing a tax on these sugary goods as they are taken through the grocery store checkout lines, the research shows that a better way is to tax the food processers on the amount of caloric sweeteners, such as corn syrup and sugar added in processing before the product hits the shelves.

The economists, John Beghin and Helen Jensen, both professors in the Department of Economics, are quick to point out that they are not advocating for or against any tax, but simply researching how and where a possible sweetener tax would be most effective.

“We are not saying. 'To resolve obesity, here is what you should do,'” said Beghin. “In that sense, we are not advocating anything. We are saying, 'Given that you are considering a panoply of tax instruments, and there is a possibility of a soda tax, is there a better way to use that idea?'”

“This is motivated,” added Jensen, “by a lot of ideas out there that say we could tax sweetened products. We wanted to see what the effect of such a tax would be and, alternatively, if you imposed a tax on ingredients, what would be the effect of that.”

The research, published in the journal Contemporary Economic Policy, shows that if the goal of a sin tax on sweeteners is to reduce calories consumed, lawmakers should consider taxing the inputs instead of the final product.

Assessing the tax at the processing stage allows food processors to reduce the amount of sweeteners they put into their products. Processors will also have incentives to use more of the lesser-taxed artificial sweeteners, and less of the higher-taxed sweeteners that are heavy in sugary products.

These solutions would also raise the price at the store less than a direct tax on the end product, while reducing the calories attributable to the sweetener, according to the study.

“Taxing the processing ingredients makes more sense when compared with taxing the end product,” said Beghin. “You can abate the same number of calories without having consumers face such high prices.”

Any new tax on sweeteners, even the tax on food inputs proposed by the study, will cause prices to go up. One drawback of any tax on sweetened goods is the regressive nature of that tax.

In economic terms, regressive taxes are those that impact poorer economic groups more than higher ones.

“Since much of these (sweeter) goods are consumed by poorer economic groups,” said Beghin, “you may be increasing the cost of calories for poor people.”

The study looks only at calories in food. The research does not make any claims about lowering obesity.

The United States' obesity rate has many factors, and the amount of calories consumed is only one, say the economists.

“We are not looking at health aspects,” said Jensen. “Just the consumption of calories from sweetened goods and the disruption to the consumer.”

The findings of the study fit generally accepted economic principles that say if you want to change a given behavior or economic decision, you should try to find a policy instrument that is closest to the behavior or decision, according to Beghin.

As part of the study, the two collected data from both government and private sources on industrial food inputs.

“We spent quite a bit of time assembling a data set based on published data on what inputs the food industry uses,” said Jensen. “So we know that for all the different food sectors, how much sugar and corn syrup go into that industry group's food processing. You'd be amazed to see how much sweetener goes into food processing.”

Disclosure: Beghin has been a consultant on sugar matters for the U.S. Government Accountability Office (2001), the Sweetener Users Association (2011), the American Enterprise Institute (2007), and the American Farm Bureau Federation (2004-5).

Media Contact

More Information:

http://www.iastate.eduAll latest news from the category: Business and Finance

This area provides up-to-date and interesting developments from the world of business, economics and finance.

A wealth of information is available on topics ranging from stock markets, consumer climate, labor market policies, bond markets, foreign trade and interest rate trends to stock exchange news and economic forecasts.

Newest articles

Silicon Carbide Innovation Alliance to drive industrial-scale semiconductor work

Known for its ability to withstand extreme environments and high voltages, silicon carbide (SiC) is a semiconducting material made up of silicon and carbon atoms arranged into crystals that is…

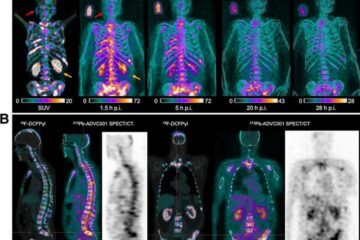

New SPECT/CT technique shows impressive biomarker identification

…offers increased access for prostate cancer patients. A novel SPECT/CT acquisition method can accurately detect radiopharmaceutical biodistribution in a convenient manner for prostate cancer patients, opening the door for more…

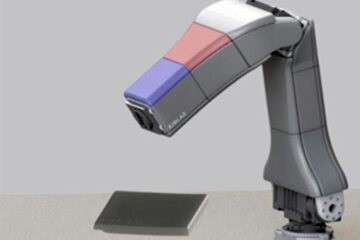

How 3D printers can give robots a soft touch

Soft skin coverings and touch sensors have emerged as a promising feature for robots that are both safer and more intuitive for human interaction, but they are expensive and difficult…