1st half of 2011: Continued strong demand for KfW financing

In the first half of 2011, KfW Bankengruppe achieved a promotional business volume of EUR 40.6 billion (after EUR 41.9 billion in the first half of 2010). The greatest portion, EUR 30.3 billion (first half of 2010: EUR 36.7 billion) went to the promotion of the German economy.

This decline in domestic lending after the phase-out of the economic stimulus programmes is in line with expectations and reflects the subsidiary role of KfW as a promotional bank. However, if we look at the promotion of small and medium-sized enterprises without the economic stimulus programme (KfW Special Programme), then the volume of commitments is stable at EUR 10.9 billion, on a similar level as at the end of the first half of 2010 (EUR 11.6 billion).

KfW's international business developed very positively, contributing EUR 10.3 billion (EUR 5.2 billion) to the half-year result. The new commitments of KfW IPEX-Bank accounted for a significant share of this result, acting as a sort of indicator of the strong growth of the export industry. Cooperation with developing and transition countries also reached a high volume of commitments of EUR 2.0 billion (EUR 2.3 billion).

“In the second half, KfW will further expand its commitment in climate and environmental protection and in this way support the German energy turnaround. Its implementation is a task for the whole nation in which we cannot be successful without financial effort”, said Dr Ulrich Schröder, Chief Executive Officer of KfW Bankengruppe.

As an important building block for this, the KfW Offshore Wind Energy Programme, in which enterprises have expressed strong interest, was launched already in June. The first agreement for the financing of a wind farm off the coast of Helgoland was signed last week.

The consolidated profit, which includes IFRS effects from hedging, was EUR 1,764 million (EUR 980 million), a new historic high. The consolidated profit before IFRS effects from hedging* also reached a sizeable volume of EUR 1,173 million (EUR 1,335 million), a continuation of the positive development of the first quarter.

“2011 will again be an exceptional year for KfW. We are pleased with this half-year result, which forms an important basis for our further work but is clearly above our sustainable earnings potential and cannot be continued into the second half. The earnings situation secures KfW's long-term promotional capabilities – also with a view to Basel III and the more difficult economic conditions posed by the sovereign debt situation”, said Dr Schröder.

The operating result before valuations was on a high level of EUR

982 million and higher than expected, but below last year's outstanding level of EUR 1,126 million. This good result was again mostly due to the high net interest income of EUR 1,224 million (EUR 1,348 million), which is mainly a result of the continuing low interest rates in the short-term segment. Interest rate reductions totalled EUR 280 million, slightly more than in the first half of 2010.

Risk provisions for lending business were reduced by a net total of EUR 169 million on the basis of the continuing economic recovery that was particularly evident in individual business segments of export and project finance. Charges of EUR 64 million had still been incurred in the same period in 2010.

The equity investment and securities portfolio yielded a positive effect of EUR 8 million (EUR 155 million) despite charges of EUR 99 million from the write-down of Greek government bonds – with a nominal volume of EUR 249 million – to their market value. Against 31 December 2010, hidden obligations under securities reduced significantly by EUR 179 million to EUR 716 million.

The purely IFRS-related effects from the valuation of derivatives used for hedging purposes amounted to EUR 592 million (expenses of EUR 355 million), increasing the valuation result considerably. This was mostly caused by reversal effects from the previous years and by opposing interest rate and currency developments.

The results of KfW's promotional activities in detail

As expected, in the business area KfW Mittelstandsbank the volume of new business was lower than in the first half of 2010, at EUR 11.6 billion (EUR 16.4 billion). This was primarily due to the phase-out of the economic stimulus packages, particularly the KfW Special Programme, at the end of 2010. As a result, the volume of commitments in the priority area of business start-ups and general corporate finance fell from EUR 8.8 billion to EUR 5.8 billion. In the area of innovation finance, in turn, commitments increased from EUR 1.4 billion to EUR 1.7 billion. In the priority area of environmental protection finance the promotional business volume dropped from EUR 6.2 billion to EUR 4.1 billion. This was due to a decline in the demand for loans from the KfW Renewable Energies Programme to finance photovoltaic installations. Here commitments again returned to normal after the record volume of 2010 following the reduction of the feed-in tariff under the Renewable Energy Sources Act. On the other hand, demand for loans under the ERP Environmental Protection and Energy Efficiency Programme was significantly higher than in the same period last year.

In the business area KfW Privatkundenbank, the volume of commitments was EUR 8.4 billion, slightly below the level of the first half of 2010 (EUR 9.5 billion) as a result of pull-forward effects that occurred last year. Commitments and investment grants under the housing programmes totalled EUR 7.5 billion. Here the focus is on the promotion of energy-efficient and barrier-free homes (EUR

3.1 billion) and the formation of home ownership (EUR 3.4 billion).

The increase in applications received reflects the positive trend in the construction of new homes. In education finance the volume of commitments rose slightly to around EUR 890 million.

In the business area KfW Kommunalbank the financing of infrastructure reached a volume of commitments of EUR 1.9 billion, exceeding the volume of the same period last year (EUR 1.7 billion). A very positive business development was especially evident in the basic programmes for the promotion of municipal investments. Demand by municipal and social enterprises in particular was significantly stronger than in the same period last year. In the business of general refinancing for promotional institutions of the federal states, KfW recorded a contract volume of just under EUR 8.4 billion.

In the business area of export and project finance, which KfW IPEX-Bank handles within KfW Bankengruppe, new business commitments totalled EUR 6.5 billion in the first half-year (EUR 3.0 billion). Energy and the environment were an important driver for growth, accounting for EUR 1.1 billion (EUR 0.5 billion). This positive development was also supported by the areas of shipping, with EUR 1.2 billion (EUR 0.5 billion) as well as aviation and rail transport, also with EUR 1.2 billion (EUR 0.3 billion). In addition, KfW IPEX-Bank provided EUR 1.9 billion for bank funding under the ship financing CIRR, which is agency business conducted for the Federal Government.

In the German securitisation market KfW expects business to stabilise on the previous year's level in 2011. KfW's commitments in the area of asset securitisation and capital market-related products were moderate in the first half-year, amounting to EUR 0.2 billion (EUR 0.3 billion).

KfW Entwicklungsbank committed some EUR 1.6 billion (EUR 1.8 billion) in the business area promotion of developing and transition countries. KfW contributed EUR 943 million in own funds to development cooperation. The financing volume of DEG was EUR 411 million, a similar volume as in the first half of 2010 (EUR 409 million). Nearly half the new commitments were for projects in the financial sector.

As at 31 July 2011, KfW raised long-term funds for the equivalent of EUR 57.5 billion in the international capital markets. This was just under 72% of the annual funding requirement, which has recently been increased to EUR 80 billion.

*Explanation of consolidated profit before IFRS effects from hedging: Under IFRS, derivatives must be recognised at fair value in the balance sheet even if they are not used for trading, as in the case of KfW, but to hedge interest and currency risks. The opposing valuation effects of the underlying on-balance transactions thus hedged can be reported only inadequately under IFRS and therefore lead to economically inappropriate temporary earnings effects in KfW's income situation. These effects offset each other in total in the course of the overall maturity of the hedged items.

Service: An overview of the business and financial figures of KfW Bankengruppe is available for download at Newsroom/Materials for the press/Presentations and business figures.

Pressekontakt:

KfW, Palmengartenstraße 5-9, 60325 Frankfurt Kommunikation (KOM) Tel. 069 7431-4400, Fax: 069 7431-3266,

E-Mail: presse@kfw.de

Media Contact

More Information:

http://www.kfw.deAll latest news from the category: Business and Finance

This area provides up-to-date and interesting developments from the world of business, economics and finance.

A wealth of information is available on topics ranging from stock markets, consumer climate, labor market policies, bond markets, foreign trade and interest rate trends to stock exchange news and economic forecasts.

Newest articles

Superradiant atoms could push the boundaries of how precisely time can be measured

Superradiant atoms can help us measure time more precisely than ever. In a new study, researchers from the University of Copenhagen present a new method for measuring the time interval,…

Ion thermoelectric conversion devices for near room temperature

The electrode sheet of the thermoelectric device consists of ionic hydrogel, which is sandwiched between the electrodes to form, and the Prussian blue on the electrode undergoes a redox reaction…

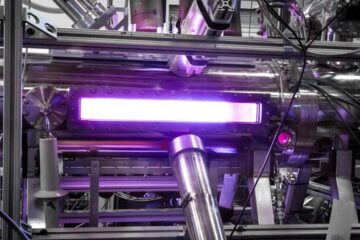

Zap Energy achieves 37-million-degree temperatures in a compact device

New publication reports record electron temperatures for a small-scale, sheared-flow-stabilized Z-pinch fusion device. In the nine decades since humans first produced fusion reactions, only a few fusion technologies have demonstrated…