'Unfunded Liabilities' a Financial Myth

Law professor Richard L. Kaplan contends the notion of “unfunded liabilities” is merely an ominous new catchphrase coined during debates over massive spending programs such as Social Security and Medicare that is rooted in financial fallacy.

“The only possible meaning of ‘unfunded liability’ is in contrast to a ‘funded liability,’ which presumably is more financially secure and apparently morally superior as well,” said Kaplan, an authority on tax law and government entitlement programs.

But in the end, he says, a “funded” liability is really no different than an “unfunded” one. To illustrate, he gave an example of parents who promise to buy their daughter a car when she graduates from college in four years.

The couple needs to invest $26,654 today to buy the car later on, assuming a $30,000 price tag and after-tax earnings of 3 percent a year, which Kaplan says are both guesses at best.

Where to invest so the cash is there when it’s needed is an even bigger rub, he says. Most Americans fund retirement and other long-term savings with a healthy percentage of stocks, which the recent economic crisis has shown could quickly turn their “funded” liability into an “unfunded” one.

“Even if Congress were to set aside tax revenues to fund Social Security, Medicare and every other ‘liability,’ that money would still need to be invested in some kind of assets,” Kaplan said. “And those assets just might be worth much less when they’re actually needed than when they were first invested.”

Bonds are a safer alternative, and U.S. government bonds are the most trusted, he said, but are nothing more than IOUs that promise future payouts.

“Consequently, an ‘unfunded liability’ by the government to make good on some financial commitment in the future is functionally no different than a ‘funded liability’ that consists of the only dependable asset around – namely U.S. Treasury obligations,” Kaplan said.

He suggests retiring the archaic phrase, saying it “implies an alternate state of fiscal adequacy that really does not exist at all.”

“Recent events have shown that whether we are talking about stock in General Motors or Citicorp, money market mutual funds, or even bank deposits, it is the federal government that ultimately stands behind these ‘assets,’ ” Kaplan said.

Media Contact

More Information:

http://www.illinois.eduAll latest news from the category: Business and Finance

This area provides up-to-date and interesting developments from the world of business, economics and finance.

A wealth of information is available on topics ranging from stock markets, consumer climate, labor market policies, bond markets, foreign trade and interest rate trends to stock exchange news and economic forecasts.

Newest articles

Properties of new materials for microchips

… can now be measured well. Reseachers of Delft University of Technology demonstrated measuring performance properties of ultrathin silicon membranes. Making ever smaller and more powerful chips requires new ultrathin…

Floating solar’s potential

… to support sustainable development by addressing climate, water, and energy goals holistically. A new study published this week in Nature Energy raises the potential for floating solar photovoltaics (FPV)…

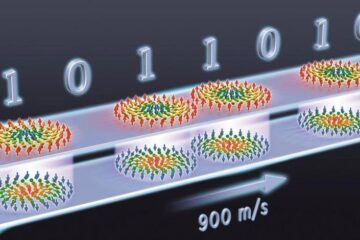

Skyrmions move at record speeds

… a step towards the computing of the future. An international research team led by scientists from the CNRS1 has discovered that the magnetic nanobubbles2 known as skyrmions can be…