Norwegian Banks in the Age of Globalisation

There is no doubt that Norwegian banks will be affected by the increased globalisation, as the present financial turbulence amply demonstrates.

There are nevertheless strong factors that will counteract and balance out the most dramatic effects of globalisation.

“These factors are first and foremost to be found in the general public’s loyalty to their local banks; often a result of tradition, local patriotism and the banks’ local knowledge. There is also the matter of legislation, in particular the Savings Banks act, which will serve as a counterbalance to globalisation,” Carl Arthur Solberg points out. He is professor of international marketing and management at BI Norwegian School of Management.

Together with Ole Helge Lien, MBA, he has conducted a study into the globalisation of the banking industry. They have paid particular attention to the effects the increased globalisation might have on Norwegian banks. The findings of this study have been published in a new research report by the BI Norwegian School of Management.

Three scenarios

The BI researchers have outlined three different scenarios for Norwegian banks in the next ten years – up to 2018: a baseline scenario, a technological breakthrough and the global banking industry.

The impact of the globalisation will be more or less dramatic for Norwegian banks, depending on which scenario proves right.

In the case of the baseline scenario, Norwegian Banks do not face much risk from globalisation, according to Solberg and Lien.

“This is not to say that it’s necessarily business as usual for the banks,” underlines Mr. Solberg.

Several development trends combine to impact on the external conditions for Norwegian banks. More terms and conditions for the development of Norwegian banking will be decided by the EU.

Amendments to the EU regulations as well as technical innovations will play an important part in shaping developments in the future. EU legislation on the role of the supervisory authorities and changes to tax rules will also have an effect on the banking industry and make it easier for banks to compete in other countries.

Technological breakthroughs will change the ground rules

Economies of scale in the field of IT or back office do not seem to have changed the banking business much to date.

“New technologies and new uses of technology might change this picture, however,” explains Mr. Solberg, introducing a new potential scenario for Norwegian banks: the technological breakthrough.

New technologies may enable more new players to take on new roles in the financial markets. This might consist of new mobile and internet banks, or of entirely new constellations, such as a cooperation between banks, data transmission companies (e.g. Telenor) and service suppliers (application companies, such as Norwegian Luup).

DnBNOR facing globalisation pressure

Should the scenario with global banking business prove right, this might have a significant impact on Norway, especially in the savings bank sector, Solberg predicts. This will likely lead to mergers between the savings banks, and probably also acquisitions by foreign banks looking to get a foothold in Norway/Scandinavia.

This development will depend largely on internal political processes in the EU, where considerations on the savings banks’ status is a central issue.

In this scenario, even the largest bank in Norway, DnBNOR, will feel the pressure from the outside, according to the researchers.

“The overriding problem for this bank is that it has been slow to move towards internationalisation, and is thus left without any clear-cut alternatives in a more globalised banking world,” the report states.

The report was completed prior to the recent dramatic developments in the financial markets, and has therefore not accounted for these in its assessments.

“The banking industry is likely to see further consolidations in the near future, and this will pose new challenges to Norwegian banks. It is also probable that the globalisation trends will be put on the back burner for some time, so that a new banking structure gets time to settle in the wake of the crises,” says Mr. Solberg.

The report discussed the potential future strategy for five Norwegian banks: Sparebanken Lillestrøm, SR Bank, DnBNOR, Storebrand Bank and Nordea.

Reference:

Solberg, Carl Arthur and Lien, Ole Helge: Globalisation of the banking industry: Its impact on Norwegian banks and the Norwegian banking industry, Research report, BI Norwegian School of Management (in Norwegian).

Media Contact

More Information:

http://www.bi.noAll latest news from the category: Business and Finance

This area provides up-to-date and interesting developments from the world of business, economics and finance.

A wealth of information is available on topics ranging from stock markets, consumer climate, labor market policies, bond markets, foreign trade and interest rate trends to stock exchange news and economic forecasts.

Newest articles

Superradiant atoms could push the boundaries of how precisely time can be measured

Superradiant atoms can help us measure time more precisely than ever. In a new study, researchers from the University of Copenhagen present a new method for measuring the time interval,…

Ion thermoelectric conversion devices for near room temperature

The electrode sheet of the thermoelectric device consists of ionic hydrogel, which is sandwiched between the electrodes to form, and the Prussian blue on the electrode undergoes a redox reaction…

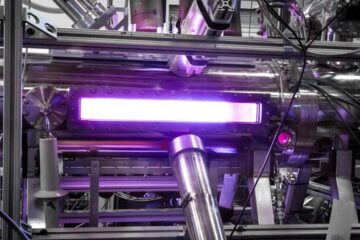

Zap Energy achieves 37-million-degree temperatures in a compact device

New publication reports record electron temperatures for a small-scale, sheared-flow-stabilized Z-pinch fusion device. In the nine decades since humans first produced fusion reactions, only a few fusion technologies have demonstrated…