Grain Prices Rebound from Flu-Linked Declines

Darrel Good says corn, soybean and wheat prices dropped sharply this week in the first trading session after reports of a virus in Mexico that was spreading into the U.S.

“Because the incidences were referred to as swine flu, the concern was that demand for pork and therefore the demand for livestock feed would decline,” he said. “For now, that concern has been overshadowed by other factors and the prices of corn, soybeans and wheat moved sharply higher at the end of April.”

Good says grain prices were driven up by more traditional market influences, including reduced estimates of Argentina’s soybean harvest, large weekly U.S. corn and soybean exports, and extremely wet conditions in the eastern Corn Belt.

“Those wet conditions threaten to push corn planting beyond the optimal date for maximum yield potential and threaten the yield of the soft red winter wheat crop that will be harvested in June and July,” said Good, a professor of agricultural and consumer economics.

Spot cash prices for soybeans ended April at a seven-month high near $10.50 a bushel, while corn sold for $3.80 a bushel, at the high end of a price range seen since last fall, he said. Cash wheat prices also recovered from Monday’s tumble, gaining about 50 cents a bushel.

“Such a negative reaction is typical with episodes that create so much uncertainty,” Good said. “The hope is that the initial knee-jerk reaction will be followed by more thoughtful responses. The extent of reported influenza cases will be important in determining the depth of demand worries.”

Hog prices, however, have yet to recover, he said. Lean hog futures traded near $70 per hundredweight on April 24, but dropped to $58 by April 30 amid worries sparked by the term “swine flu.”

U.S. and world health officials have since sought to restore public confidence by giving the virus new names, such as H1N1 or Influenza A, saying the strain of influenza cannot be contracted by eating pork products.

Still, several countries have placed restrictions on pork imports from Mexico and the U.S., Good said. He says the limits could have serious price implications in the U.S., which typically exports nearly 20 percent of its pork production.

“At this juncture, it is not possible to predict the extent of the spread of H1N1,” Good said. “However, widespread recognition that H1N1 does not threaten the quality of pork may temper the concerns about pork consumption and allow hog prices to recapture the losses experienced this week.”

Media Contact

More Information:

http://www.illinois.eduAll latest news from the category: Business and Finance

This area provides up-to-date and interesting developments from the world of business, economics and finance.

A wealth of information is available on topics ranging from stock markets, consumer climate, labor market policies, bond markets, foreign trade and interest rate trends to stock exchange news and economic forecasts.

Newest articles

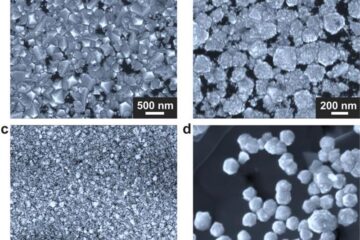

Making diamonds at ambient pressure

Scientists develop novel liquid metal alloy system to synthesize diamond under moderate conditions. Did you know that 99% of synthetic diamonds are currently produced using high-pressure and high-temperature (HPHT) methods?[2]…

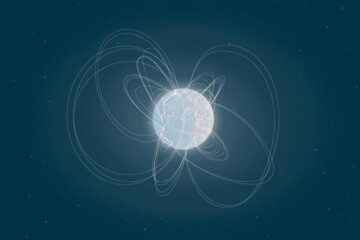

Eruption of mega-magnetic star lights up nearby galaxy

Thanks to ESA satellites, an international team including UNIGE researchers has detected a giant eruption coming from a magnetar, an extremely magnetic neutron star. While ESA’s satellite INTEGRAL was observing…

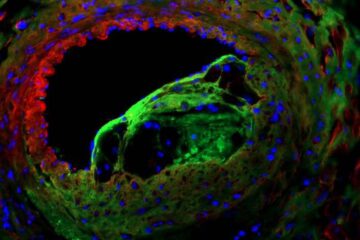

Solving the riddle of the sphingolipids in coronary artery disease

Weill Cornell Medicine investigators have uncovered a way to unleash in blood vessels the protective effects of a type of fat-related molecule known as a sphingolipid, suggesting a promising new…