Divorce costs thousands of women health insurance coverage every year

And this loss is not temporary: women’s overall rates of health insurance coverage remain depressed for more than two years after divorce.

“Given that approximately one million divorces occur each year in the U.S., and that many women get health coverage through their husbands, the impact is quite substantial,” says Bridget Lavelle, a U-M Ph.D. candidate in public policy and sociology, and lead author of the study, which appears in the December issue of the Journal of Health and Social Behavior.

Lavelle conducted the study, which analyzes nationally representative longitudinal data from 1996 through 2007 on women between the ages of 26 and 64, with U-M sociologist Pamela Smock. Their research was supported by the U-M National Poverty Center.

Among the other key findings of the study:

Each year, roughly 65,000 divorced women lose all health insurance coverage in the months following divorce. Many women have trouble maintaining private insurance coverage because they no longer qualify as dependents under husbands’ policies or have difficulty paying premiums for other sources of private insurance. And despite the financial hardship divorced women often experience, many do not qualify for Medicaid or other public insurance.

Women insured as dependents on their husband’s employer-based insurance policy are particularly vulnerable to loss of coverage after divorce. Nearly one-quarter of them are uninsured six months after divorce.

Women who have their own employer-based coverage are less likely than other women to lose coverage (11 percent vs. 17 percent) but they are not completely immune from loss of coverage because financial losses related to the divorce may reduce their ability to meet ordinary expenses, including their share of employee-sponsored health insurance.

“Women in moderate-income families face the greatest loss of insurance coverage,” says Lavelle. “They are more likely than higher-income women to lose private coverage and they have less access than lower-income women to public safety-net insurance programs.”

Media Contact

More Information:

http://www.umich.eduAll latest news from the category: Studies and Analyses

innovations-report maintains a wealth of in-depth studies and analyses from a variety of subject areas including business and finance, medicine and pharmacology, ecology and the environment, energy, communications and media, transportation, work, family and leisure.

Newest articles

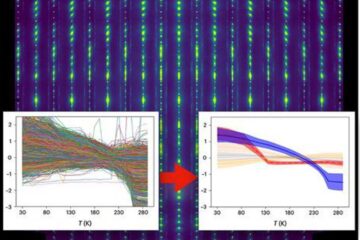

Machine learning algorithm reveals long-theorized glass phase in crystal

Scientists have found evidence of an elusive, glassy phase of matter that emerges when a crystal’s perfect internal pattern is disrupted. X-ray technology and machine learning converge to shed light…

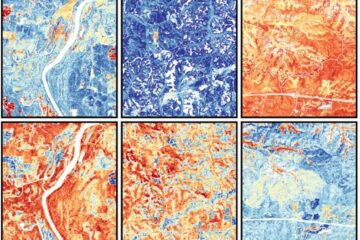

Mapping plant functional diversity from space

HKU ecologists revolutionize ecosystem monitoring with novel field-satellite integration. An international team of researchers, led by Professor Jin WU from the School of Biological Sciences at The University of Hong…

Inverters with constant full load capability

…enable an increase in the performance of electric drives. Overheating components significantly limit the performance of drivetrains in electric vehicles. Inverters in particular are subject to a high thermal load,…