The Crash of 2008: A Mathematician’s View

There is no such thing as laying off risk if no one is able to insure it. Big new risks were taken in extending mortgages to far more people than could handle them, in the search for new markets and new profits.

Attempts to insure these by securitisation – aptly described in this case as putting good and bad risks into a blender and selling off the results to whoever would buy them – gave us toxic debt, in vast quantities.

“Once the scale of the problem was unmistakably clear from corporate failure of big names in the financial world, banks stopped lending to each other,” says Bingham. “They couldn’t quantify their own exposure to toxic debt – much of it off balance sheet – so couldn’t trust other banks to be able to quantify theirs. This led to a collapse of confidence, and the credit crunch, which turned a problem in the specialised world of exotic financial derivatives into a crisis in the real world. Once the problem became systemic, government had to step in to bail the system out with vast quantities of public money.”

Professor Bingham suggests that to learn more and predict financial future, we should look to our past, likening the current crisis to the ‘Tulip Mania’ in the Netherlands in 1636 where huge prices were paid for futures in tulips, which then turned out to be as worthless as sub-prime mortgages today.

Even Alan Greenspan, the long-serving former chairman of the US Federal Reserve, admits that mistakes were made in the past. To avoid repeating these mistakes, we need to learn from them. This needs a new mind-set, new policies, and much more proactive regulation.

Bankers complain that the risk models they used predicted problems as dramatic as today’s only every few centuries. “This is like talking about the details of how to steer a boat on a river,” says Bingham, “what matters there is whether or not the river is going to go over a waterfall, like the Niagara Falls.”

Media Contact

More Information:

http://www.interscience.wiley.com/journal/significanceAll latest news from the category: Business and Finance

This area provides up-to-date and interesting developments from the world of business, economics and finance.

A wealth of information is available on topics ranging from stock markets, consumer climate, labor market policies, bond markets, foreign trade and interest rate trends to stock exchange news and economic forecasts.

Newest articles

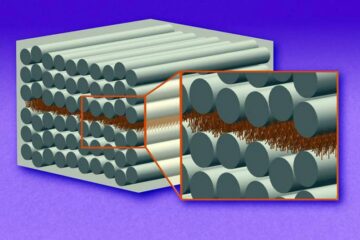

“Nanostitches” enable lighter and tougher composite materials

In research that may lead to next-generation airplanes and spacecraft, MIT engineers used carbon nanotubes to prevent cracking in multilayered composites. To save on fuel and reduce aircraft emissions, engineers…

Trash to treasure

Researchers turn metal waste into catalyst for hydrogen. Scientists have found a way to transform metal waste into a highly efficient catalyst to make hydrogen from water, a discovery that…

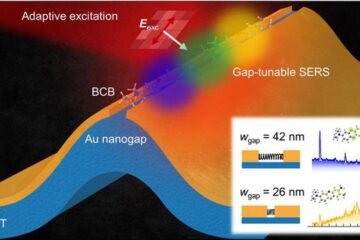

Real-time detection of infectious disease viruses

… by searching for molecular fingerprinting. A research team consisting of Professor Kyoung-Duck Park and Taeyoung Moon and Huitae Joo, PhD candidates, from the Department of Physics at Pohang University…